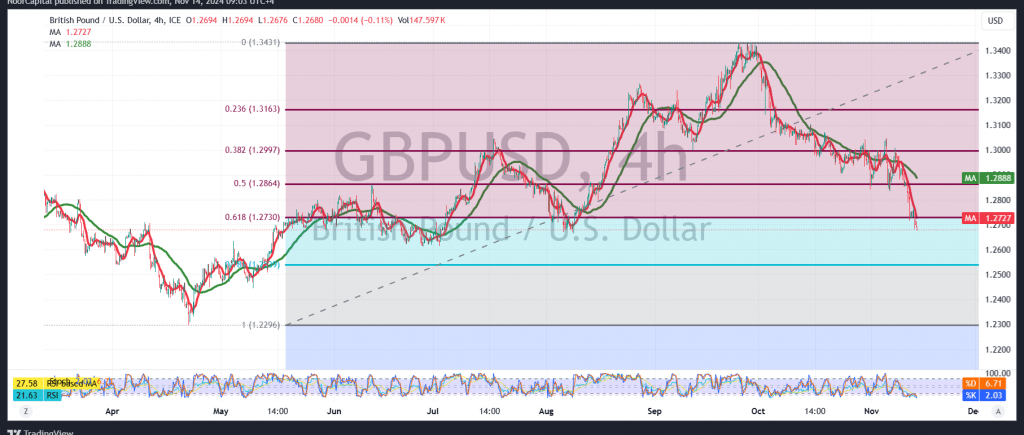

The British pound has continued its decline against the US dollar, staying within the anticipated bearish trend. The pair is nearing the first target of the previous analysis at 1.2665, having touched a low of 1.2683 during the morning session.

Technically, the 4-hour chart reveals that the pair has confirmed the break of the 1.2735 support level, which has now turned into resistance as per the role-reversal principle. Additionally, the Relative Strength Index (RSI) continues to generate bearish signals, reinforcing the likelihood of further declines.

We maintain a bearish outlook, targeting 1.2665, with a break below this level opening the path for further downside moves to 1.2600 and ultimately 1.2560.

Conversely, if the pair holds above 1.2740 and manages to close an hourly candle at or above this mark, there could be an attempt to initiate a short-term upward correction, aiming to retest 1.2800 and then 1.2840.

Caution: The release of high-impact US economic data, specifically the “Consumer Price Index – Annual and Consumer Price Index – Monthly,” could trigger significant price volatility.

Geopolitical Risk Warning: The risk environment remains elevated amid ongoing geopolitical tensions, making multiple scenarios possible.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations