The pound sterling has made significant strides against its American counterpart, breaching the pivotal resistance level highlighted in previous technical reports at 1.2650. This breakthrough has bolstered the potential for further upward movement towards 1.2675 and 1.2720, respectively, culminating in the pair reaching its highest point at 1.2710 along the anticipated upward trajectory.

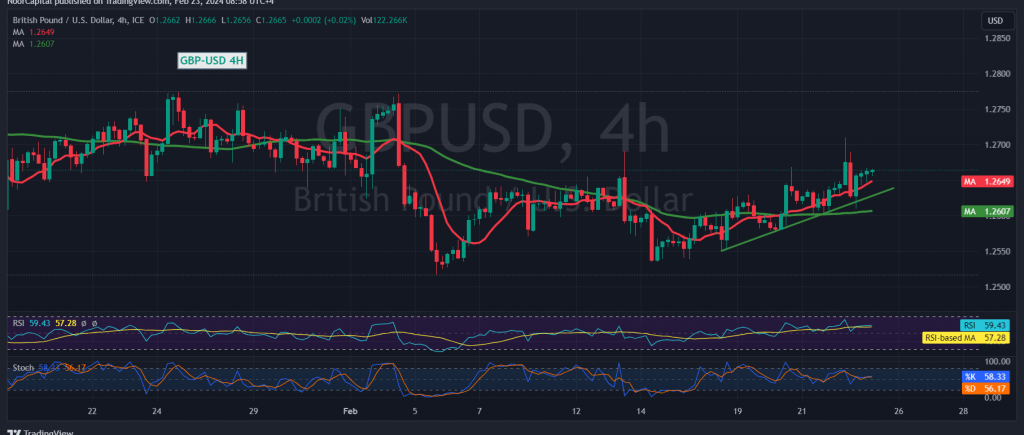

Examining the technical landscape today, a detailed analysis of the 4-hour chart reveals the pair’s efforts to consolidate above the critical level of 1.2650. Moreover, the Relative Strength Index (RSI) continues to exhibit positive signals.

Given intraday trading conditions remaining above 1.2650 and generally above 1.2615, the bullish momentum persists with a target set at 1.2710. Notably, breaching this level would confirm further upward movement in the short term, potentially reaching 1.2760.

However, a close below 1.2650, particularly on at least an hour candle basis, may temporarily dampen the upward momentum without nullifying it entirely. In such a scenario, a limited bearish bias could emerge, aiming for a retest of 1.2615 before resuming upward attempts.

It’s essential for traders to monitor these levels closely and adapt their strategies accordingly to navigate potential shifts in market dynamics.

By staying attuned to critical levels and potential reversal scenarios, traders can navigate the fluctuations within the pound sterling-US dollar pair with heightened precision and confidence.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations