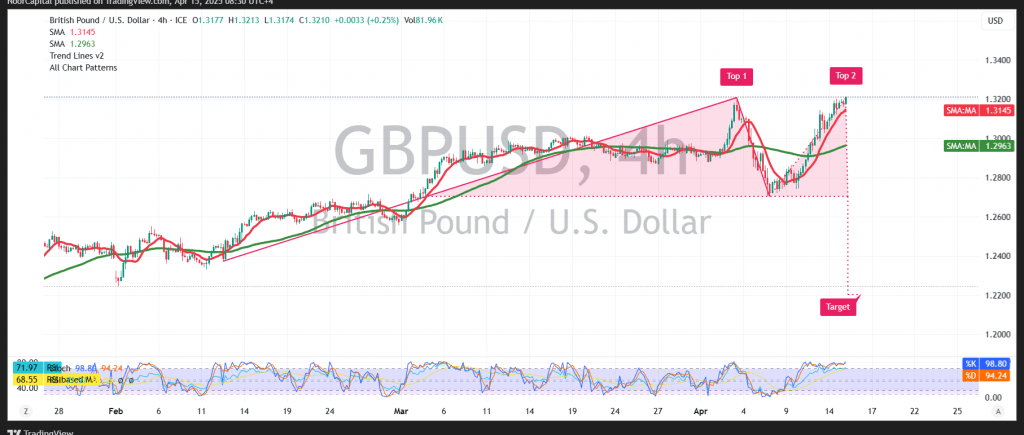

The British pound remains firmly in an uptrend against the U.S. dollar, with the pair recently testing the psychological barrier at 1.3200.

From a technical perspective, the 4-hour chart shows continued support from the simple moving averages, which are reinforcing bullish momentum. However, momentum indicators—particularly the RSI—are now signaling overbought conditions, suggesting the potential for a short-term corrective pullback.

This opens the door for a possible temporary decline, with initial support levels to watch at 1.3110 and 1.3065. A pullback toward these areas could offer the pair a chance to reset before resuming its upward trajectory.

On the upside, a confirmed breakout and price consolidation above 1.3250 would likely neutralize any short-term bearish pressure, paving the way for a continuation toward the next key resistance at 1.3300.

Risk Disclaimer: With ongoing global trade tensions and increased market uncertainty, risk levels remain elevated. Traders should be prepared for sharp movements in either direction.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations