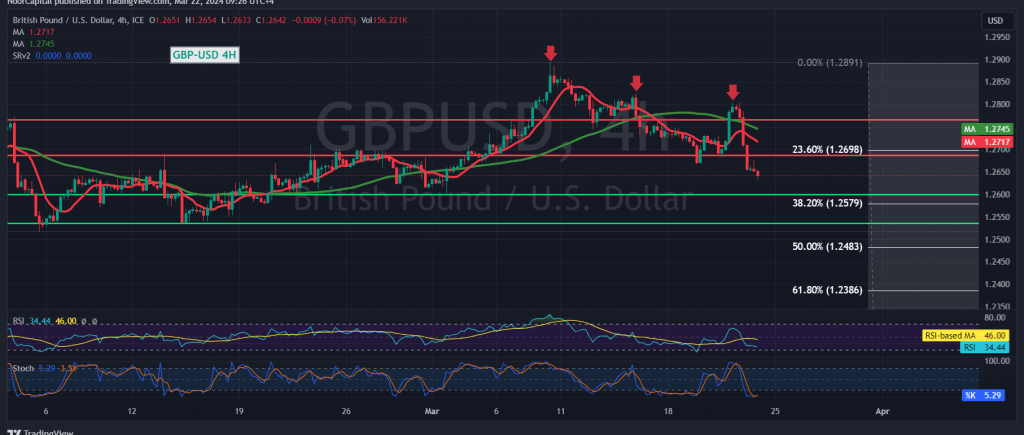

The British pound concluded yesterday’s trading session on a downward trajectory after encountering resistance at the psychological barrier of 1.2800, which exerted downward pressure on the price, resulting in a decline to its lowest level at 1.2635.

From a technical perspective today, the price remains stable below the 50-day simple moving average, with intraday movements consolidating below the psychological barrier of 1.2700.

As a result, there is a possibility of a downward correction, with the initial target set at 1.2585. It’s crucial to monitor this level closely, as a breach could intensify and accelerate the downward correction, potentially leading to a further decline towards 1.2525.

On the upside, consolidation above the psychological barrier resistance at 1.2700 could invalidate the aforementioned scenario, prompting a retest of 1.2750 initially.

Warning: Today’s trading may be influenced by Jerome Powell’s speech, Governor of the Federal Reserve, as well as the release of the monthly retail sales index from the United Kingdom. Therefore, we may experience significant price fluctuations.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations