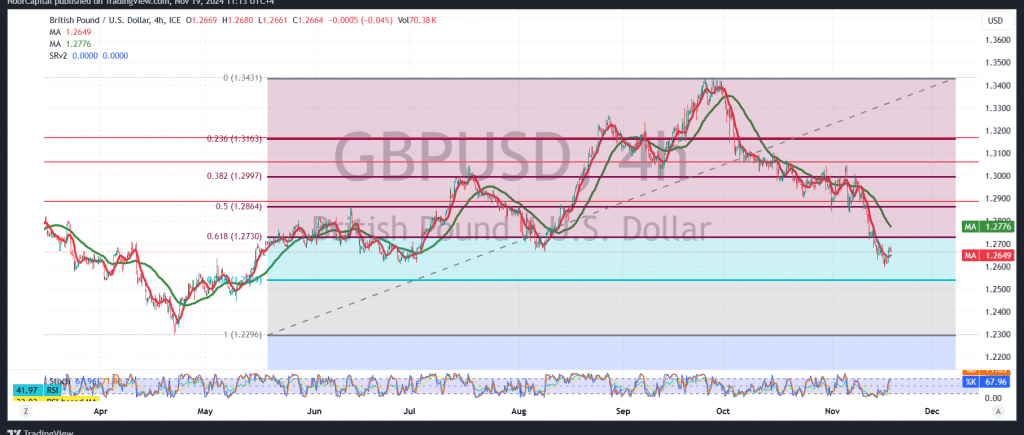

The British pound has experienced a noticeable rally against the US dollar, recovering from prior declines that saw it test support near the psychological barrier at 1.2600, and extending gains to reach 1.2690.

Technical Analysis:

Currently, the 4-hour chart shows a mixed outlook:

- The Relative Strength Index (RSI) is beginning to send positive signals, which could support further upward movement.

- However, the simple moving averages continue to act as resistance, limiting upward potential.

Potential Scenarios to Watch:

- Bullish Scenario: If the pair successfully consolidates above 1.2730, aligning with the 61.80% Fibonacci correction level, and closes an hourly candle above it, this could initiate a short-term uptrend. The next target would be 1.2785.

- Bearish Scenario: Conversely, if the pair stabilizes below 1.2625, the downward trend could resume, with the potential to reach 1.2540.

Warning:

Market conditions remain volatile, with geopolitical factors introducing high risk, and all scenarios should be approached cautiously.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations