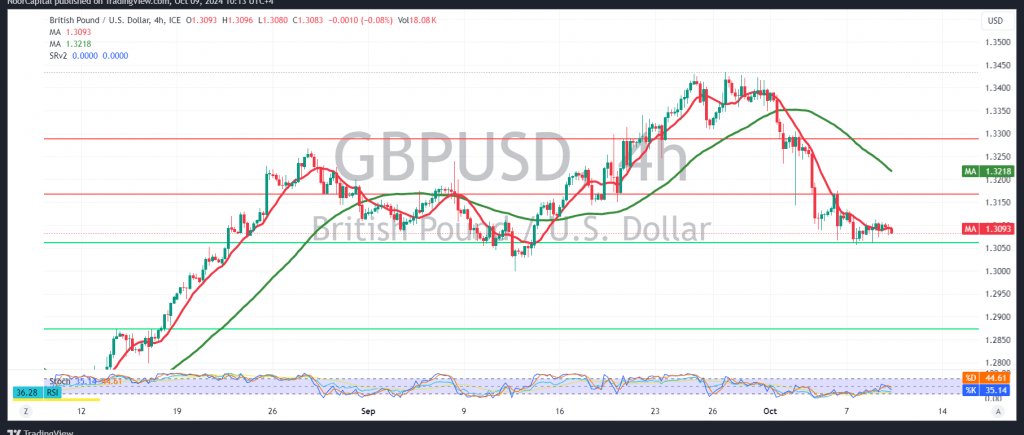

The British pound remains in a sideways trading range, attempting to stabilize above the 1.3070 support level.

Technically, we lean towards a bearish bias today, driven by the renewed pressure from the simple moving averages and the temporary stabilization of the price below the 1.3120 level.

A clear and decisive break below the pivotal support at 1.3070 is required to confirm a bearish move, which could open the path towards the next targets at 1.3040 and 1.3000, respectively.

Conversely, if the pair manages to hold above 1.3070, this could trigger an upward attempt in the short term, with the initial target around 1.3160.

Warning: Today, we anticipate high-impact economic data from the US, including the “Federal Reserve Committee meeting results,” which may cause significant price volatility.

Risk Alert: The risk level remains elevated amid ongoing geopolitical tensions, increasing the likelihood of unpredictable market movements.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations