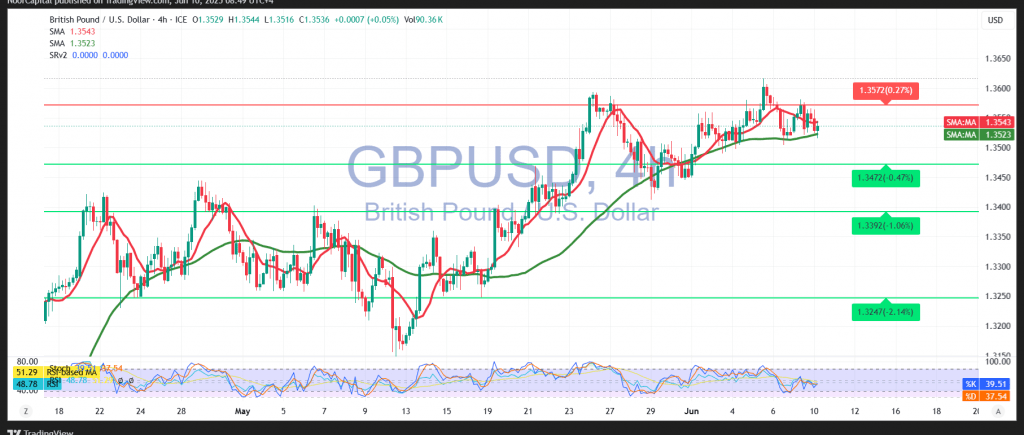

The GBP/USD pair is currently displaying a bearish intraday bias, pressured by the strong resistance zone near 1.3580, which has acted as a supply ceiling and triggered downside pressure in the short term.

From a technical standpoint, the 4-hour chart shows the pair in the process of clearing overbought conditions, as reflected by the Relative Strength Index (RSI) moderating from elevated levels. However, the simple moving averages (SMAs) beneath current price action continue to provide strong technical support, which helps to maintain the underlying bullish momentum.

As long as the pair holds above 1.3460, the broader outlook remains constructive. A break above 1.3570 would serve as a bullish confirmation and may lead to an extension toward the 1.3620 resistance area. However, failure to hold above 1.3460 would invalidate the current bullish bias and could shift momentum toward a deeper pullback.

Warning: Given the backdrop of elevated geopolitical risks and ongoing trade tensions, market volatility remains high. Traders should exercise caution, as sharp swings in either direction are possible.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations