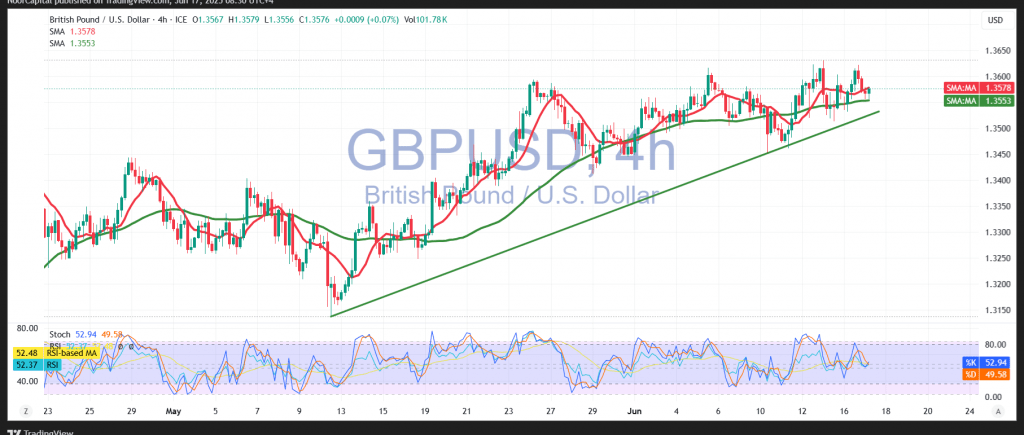

The GBP/USD pair saw limited downside movement, consolidating near the psychological resistance level of 1.3600, which has acted as a key barrier at current trading levels.

From a technical standpoint, the 4-hour chart reflects some negative momentum as the pair works through overbought conditions. However, the 14-day momentum indicator is attempting to regain strength, supported by continued stability above the simple moving averages, which serve as dynamic support.

The potential for a bullish continuation remains valid, provided the pair can decisively break above the 1.3600 resistance level. Such a breakout could pave the way for an advance toward the first target at 1.3665, followed by 1.3710 as the next potential stop.

However, if the pair falls back and stabilizes below 1.3490, this would undermine the bullish scenario and place the pair under renewed selling pressure, targeting a decline toward 1.3440.

Warning: U.S. retail sales data is due for release today, and could trigger significant market volatility.

Warning: Risk levels remain high due to ongoing trade and geopolitical tensions, making multiple outcomes possible.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations