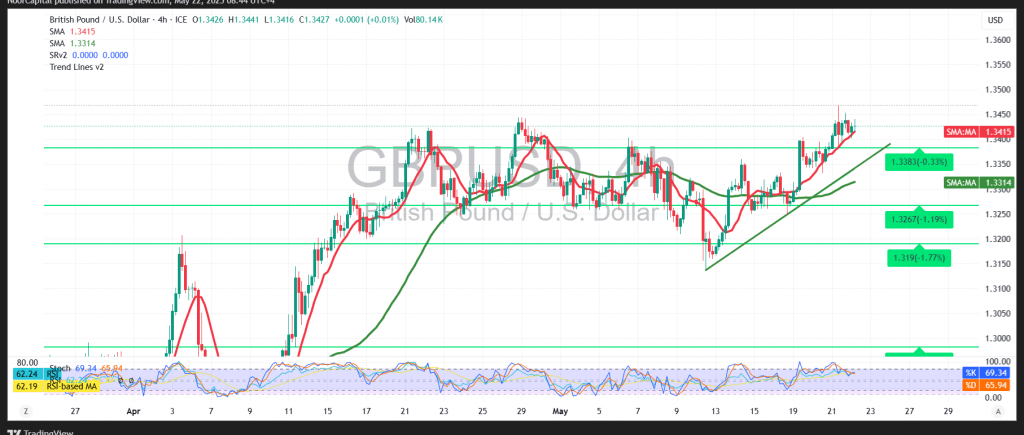

The GBP/USD pair continues to make bullish attempts, pressing against the pivotal resistance level at 1.3440, with intraday movements stabilizing near this zone.

From a technical standpoint, the 4-hour chart shows that simple moving averages are maintaining their upward slope, reinforcing bullish momentum. This is complemented by the Relative Strength Index (RSI), which is producing positive signals and attempting to build further upside traction.

If the pair manages a confirmed break above 1.3440, it would likely trigger the next leg of the uptrend, targeting 1.3470 initially. Continued bullish momentum beyond this point could lead to an extended move toward 1.3510.

However, a return to stable trading below 1.3380, particularly with a confirmed hourly candle close, could stall the current bullish scenario. This would place the pair under renewed selling pressure, with 1.3340 as the next key downside level.

Key Event Risk Today:

Markets are on alert for high-impact Services and Manufacturing PMI releases from the United States, Eurozone, and United Kingdom. These reports may induce significant volatility across currency markets, particularly GBP pairs.

Risk Disclaimer:

With persistent trade tensions and critical economic data in focus, market risk remains elevated. Traders should remain cautious and ready for sharp intraday swings in either direction.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations