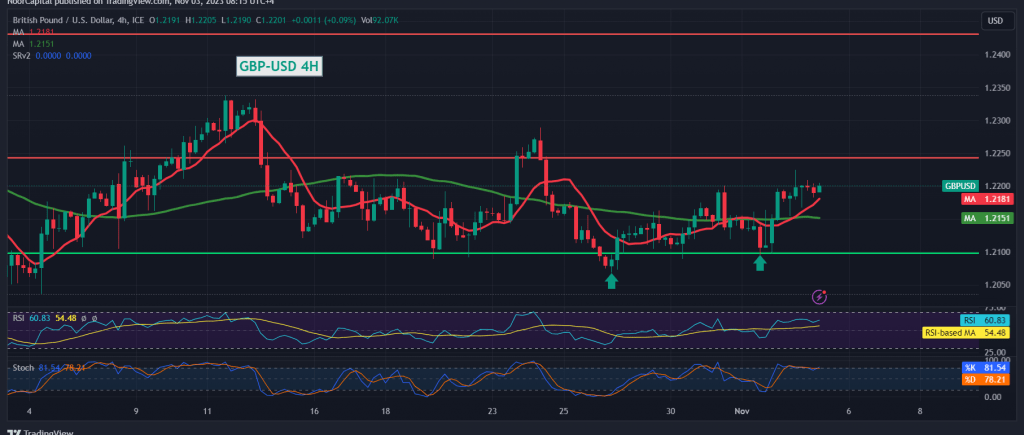

The British pound followed the anticipated gradual upward trajectory, consolidating above the psychological barrier resistance of 1.2200 and reaching its first target at 1.2220, hitting its peak at 1.2225.

From a technical perspective, the simple moving averages have once again provided positive support, coupled with clear bullish signals on the 14-day momentum indicator.

The prevailing sentiment leans towards positivity; however, confirmation of a breach and consolidation above the 1.2220 resistance level is pivotal. Such a development would pave the way for further gains, with initial targets set at 1.2270 and 1.2310.

Conversely, failure to consolidate above the psychological barrier resistance of 1.2200 and a return to trading below 1.2155 would exert negative pressure. In this scenario, the pair could target 1.2120 initially, followed by 1.2080. Traders should closely monitor these levels for potential market movements.

Please note that we are anticipating high-impact economic data from the American economy, including non-farm payroll, unemployment rates, average wages, and the services purchasing managers index issued by ISM. Additionally, we are awaiting Canadian economic data, specifically the unemployment rate and job changes. Market fluctuations are expected upon the release of these news items.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations