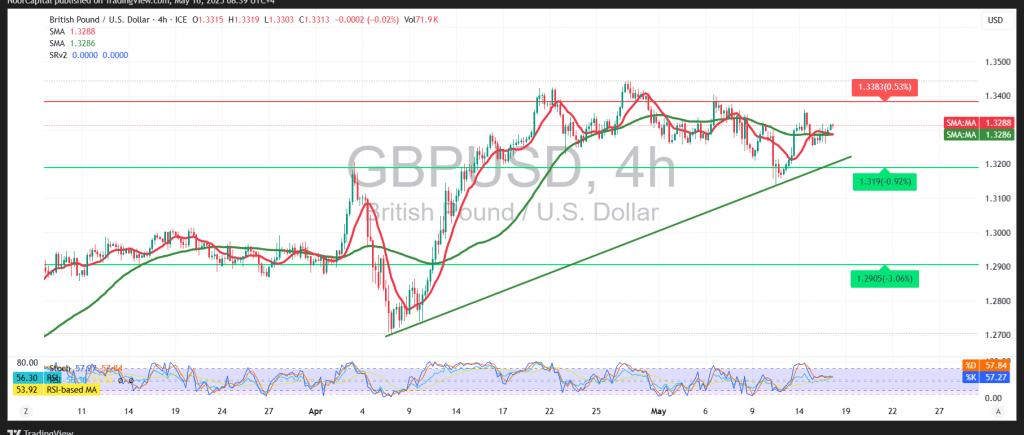

The GBP/USD pair extended its upward movement in the previous session, supported by the pivotal 1.3260 level identified in the prior technical report. This level acted as a key barrier against bearish momentum, signaling that a confirmed break below it would be required to shift the bias to the downside.

On the 4-hour chart, the technical landscape has turned more constructive. Simple moving averages are once again providing upward momentum, while the Relative Strength Index (RSI) is delivering positive signals—both supporting the potential for further short-term gains.

As long as trading remains above 1.3275, the pair is likely to maintain a limited upward trend, with an initial target at 1.3345. A confirmed break above this resistance would act as a catalyst for an extended rally, with the next key level to watch at 1.3400.

Conversely, a return to stable trading below 1.3275 could neutralize the bullish outlook and shift momentum in favor of the bears, exposing the pair to a potential decline toward 1.3230.

Risk Disclaimer:

Amid continued global trade tensions and macroeconomic uncertainty, risk levels remain elevated. Traders should remain cautious and prepare for a wide range of market scenarios.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations