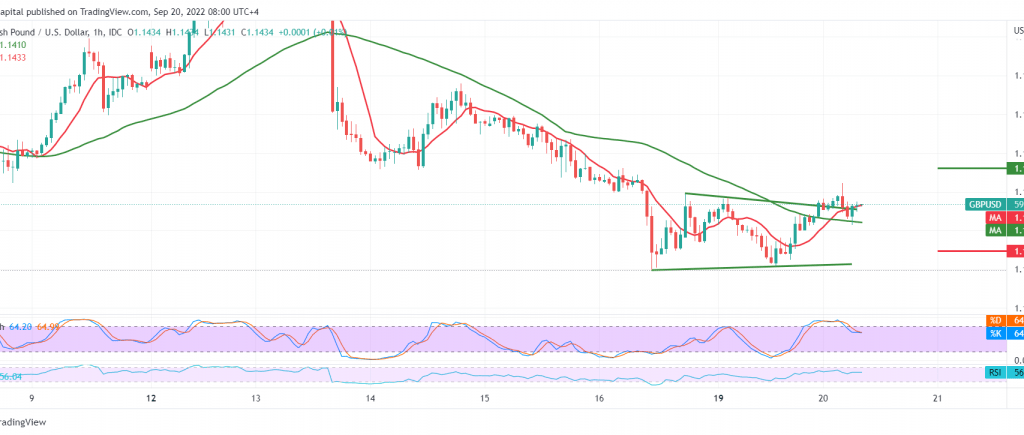

The British pound found a good support level around the first target that needed to be touched during the previous analysis at 1.1350, which forced the pair to make a bullish bounce, attacking the 1.1460 resistance level.

On the technical side, the current movements are witnessing stability above the 1.1400 barriers, as we find stochastic trying to eliminate the recent negativity in favor of continuing the rise. On the other hand, we find the 50-day simple moving average that constitutes an obstacle to the pair’s rises.

Despite the conflicting technical signals, we tend to the positive, but with caution, provided that we witness a clear and strong breach of the resistance level 1.1480/1.1470, because its breach is a catalyst that enhances the chances of rising, so we are waiting for touching 1.1520 and 1.1580, respectively.

Trading stability once again supports the psychological barrier of 1.1400 and 1.1375, which leads the pair to the current official descending wave, so we are waiting for 1.1310, and losses may extend later towards 1.1270.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations