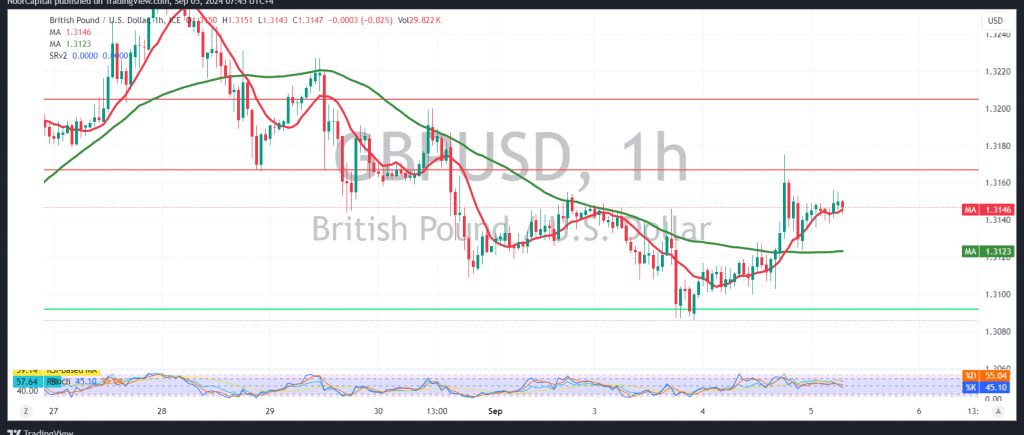

The British pound reversed its previously expected downward trend from the last technical report, where we noted the importance of trading below the resistance level of 1.3130. As anticipated, the price’s stability above 1.3130 halted the bearish scenario, leading the pair to retest 1.3170, reaching a high of 1.3175 and compensating for earlier sell positions.

From a technical perspective today, by closely examining the 4-hour chart, we see the pair finding temporary support above the breached resistance at 1.3130, with the 50-day simple moving average now providing additional support from below.

Thus, there is potential for an upward trend in the coming hours, initially targeting 1.3180. A breach of this level could extend gains toward 1.3210 and 1.3230 in the short term.

However, if the price returns to stability below 1.3130, and more critically below 1.3100, it may resume the downward correction, with targets at 1.3065 and 1.3040, respectively.

Alert: We are awaiting high-impact economic data from the U.S. today, including Non-farm private sector jobs data, weekly unemployment claims, and the ISM Services PMI. High volatility in prices is expected around the release time.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations