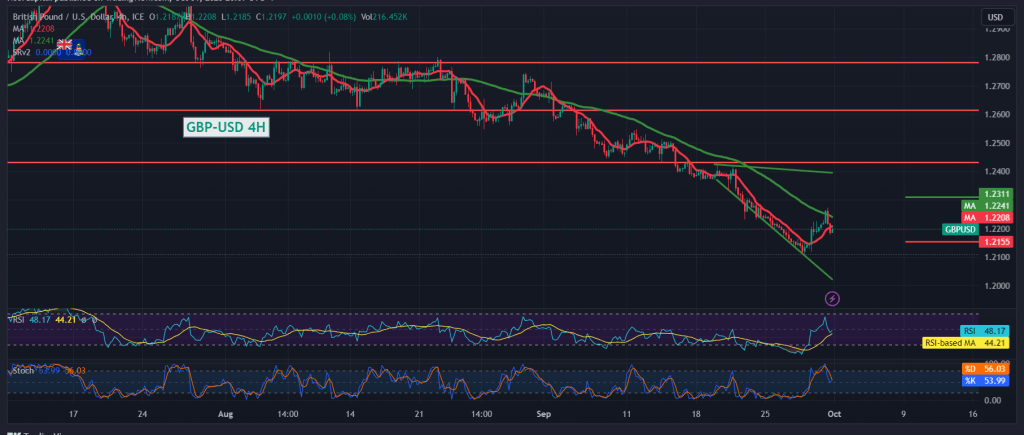

Positive trades dominated the movements of the pound sterling against the US dollar within the expected upward path during the previous technical report, touching the bullish retest target of 1.2260, recording its highest level of 1.2272.

On the technical side today, we find current trading stable above the previously breached resistance and converted into a support level according to the concept of exchanging roles, in addition to the stability of the relative strength index above the 50 midline.

We may witness a resumption of the upward trend that began during the previous session, noting that the jump upwards and the price’s consolidation above 1.2250 will enhance the gains, as we wait for 1.2310, the next station whose gains may extend later to visit 1.2345.

Only from below, the return of trading stability below 1.2150/1.2160 with the closing of at least an hour candle will completely stop attempts to rise and lead the pair to the official bearish path, with targets starting at 1.2120 and 1.2070 as next stations.

Note: Today we are awaiting high-impact economic data issued by the US economy, the Manufacturing Purchasing Managers’ Index, and the speech of Federal Reserve Chairman Jerome Powell, and we may witness high price fluctuations at the time the news is released.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations