US dollar has ceased its upward trajectory since the release of US economic data indicating a slowdown in consumer prices. This data has reinforced expectations that the Federal Reserve is likely begin cutting interest rates at its September meeting.

This data has fuelled speculation that the Federal Reserve is likely to start rate cut September meeting as inflation retracement is a good sign for Fed as it imply that the central bank is nearer to it official target of inflation – 2.00% – so that it gives mor comfort to FOMC members as they are considering the start of rate cut.

Markets have become increasingly optimistic as Fed edges closer to normalizing monetary policy through interest rate cuts, which improved risk appetite and added more downside pressure to USD price action throughout last week trading.

Meanwhile, the second reason is that inflation data reinforces market expectations of a rate cut in September FOMC meeting in a manner that won’t l shock the markets. Speculations of a 50 basis point rate cut have significantly diminished, with the probability of this scenario dropping to 13%. Investors have largely maintained their expectations of a 25 basis point cut, which has further fuelled market optimism. Against the US dollar, US stocks and other rick assets as well as gold futures benefitted from the decline of the greenback.

US inflation readings

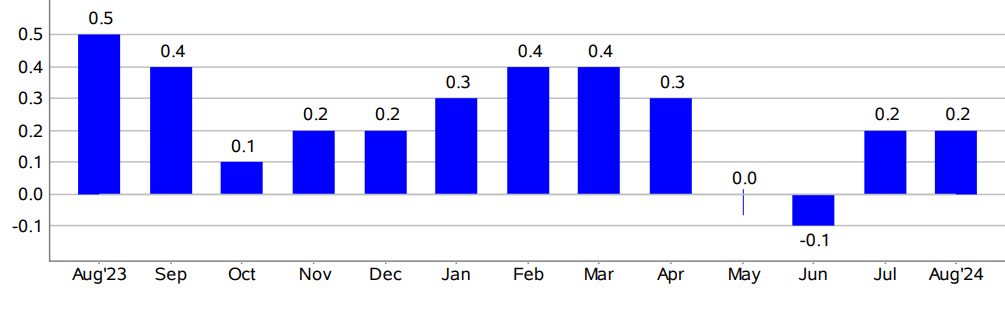

US CPI increased by 0.2% in August, mirroring the previous month’s reading and matching expectations, suggesting a stagnation in price growth according to the monthly index reading.

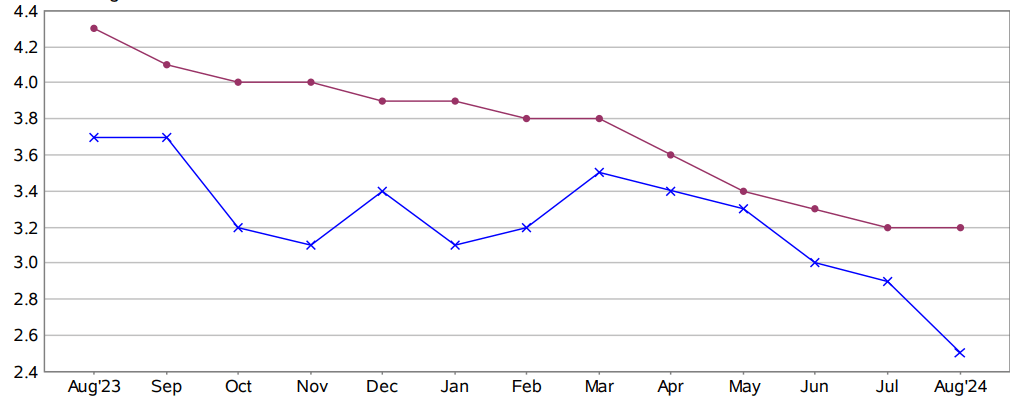

On annual basis, the consumer price index in August rose by only 2.5% compared to 2.9% in the same month last year, falling below market expectations of 2.6%.

When calculating CPI ex Food & Energy prices, the US index rose by 0.3% in August, versus a 0.2% increase in July, which was higher than market expectations of 0.2%.

Meanwhile, the annual reading increased by 3.2% in August, matching both the previous year’s reading and market forecasts.

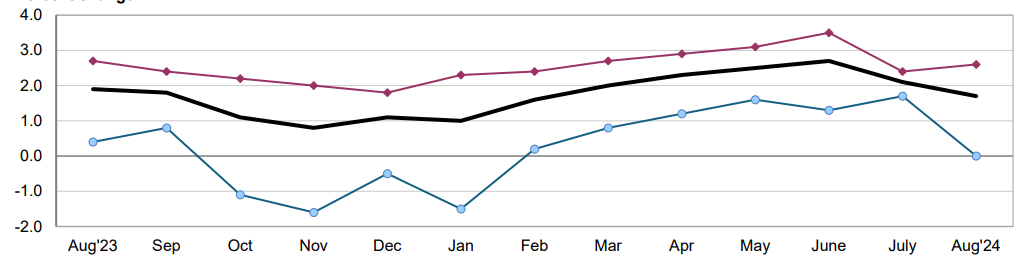

Inflationary pressures have also shown signs of easing. The Producer Price Index (PPI), a measure of wholesale prices, increased at a slower-than-expected pace, suggesting a potential moderation in inflationary trends. This development could lead to a reduction in the Federal Reserve’s need for aggressive interest rate hikes.

Euro and ECB

If you are looking for a reason for the Euro uptrend after ECB decided to cut interest rate, I’ll give you two or even three reasons which sin this piece of analysis.

The Euro’s resilience in the face of the ECB’s rate cut can be attributed to a combination of factors. Market expectations, confidence in inflation targeting, the lack of clear guidance, and the overall economic outlook all contributed to the currency’s strength. As the Eurozone continues to navigate economic challenges, its performance will remain closely watched by investors and policymakers alike.

When we know that the central bank added to another episode to series of rate cut, the first thing jumps in mind is that the single currency is on its way to lose more value because of being less attractive to investors after its yields go south. But this was not the case after last Thursday rate decision as Euro showed resilience for some reasons.

The first one is that the ECB’s board of governors head Christine Lagarde and Co. were strongly expected to cut rates and markets priced this move since the last meeting of the monetary policy committee.

The second reason is the ECB’s language surrounding inflation was a key factor in supporting the Euro. The central bank expressed confidence in its ability to achieve its inflation target, implying a potential for future rate hikes. This forward-looking stance bolstered investor confidence in the Euro’s long-term prospects.

The third and the last reason was the complete absence of specific guidance regarding future monetary policy move which played a role in the Euro’s appreciation. The ECB’s decision to refrain from providing concrete hints about upcoming rate cuts created uncertainty, which can sometimes lead to market speculation and support for the currency.

On the other hand, Lagarde said the economic recovery faces headwinds, with its downside risks to growth. At the same time, she stressed that the central bank sees that the recovery to strengthen over time due to rising real incomes and fading monetary policy restrictiveness.

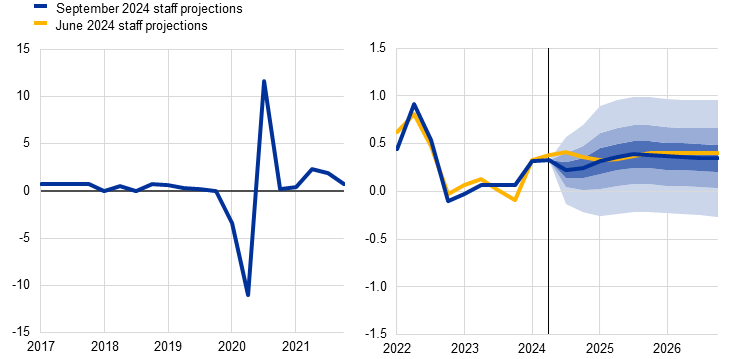

Economic projections issued by ECB included that GDP growth is now expected at 0.8% in 2025 (vs. 0.9% in June), 1.3% in 2025 (vs 1.4% in June), and 1.5% in 2026 (vs 1.5% in June). The downward revision is mainly due to weaker contributions from domestic demand over the next few quarters as private consumption and investments are weak. Meanwhile, The forecast on headline inflation was unchanged as energy futures have moved lower while the outlook for core inflation was revised slightly up.

Next week

Fed continues to dominate market discussions, with investors eagerly anticipating a rate cut at its September meeting.

For over a year, the central bank has maintained its benchmark interest rate at a 23-year high to combat soaring inflation. However, with recent economic data suggesting that inflation is easing and the labor market is softening, expectations for a rate cut have grown.

Investors are betting on reversing the current tightening cycle, hoping for a reduction in borrowing costs. This move would align with the Fed’s dual mandate of promoting maximum employment and price stability.

Following the rate decision announcement, Federal Reserve Chair Jerome Powell will hold a press conference. Investors will closely listen to his remarks for clues about the Fed’s future monetary policy path and its assessment of the economic outlook.

FOMC rate decision and Powell’s comments will likely have a significant impact on financial markets, influencing everything from stock prices to bond yields.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations