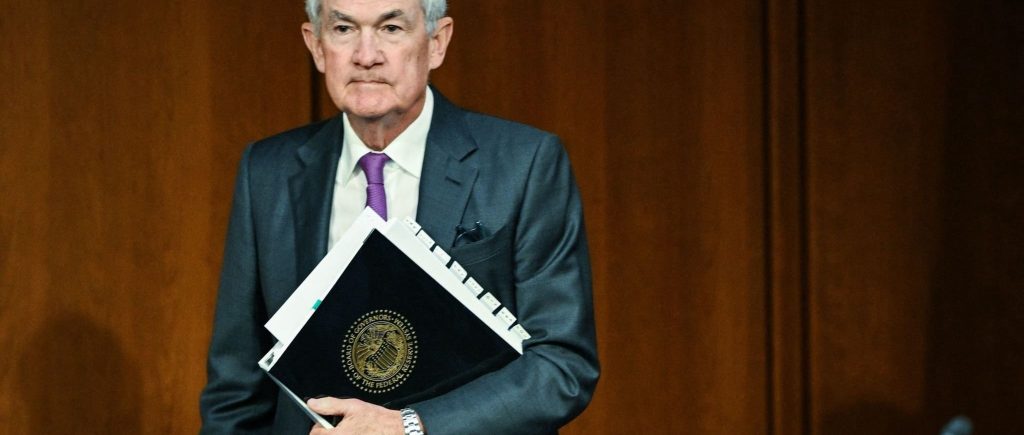

The Federal Reserve Chair Jerome Powell stated on Tuesday that the US central bank is unlikely to lower interest rates at its next policy meeting, which is just two weeks away, due to the US economy’s continued strength and a “lack of progress” on inflation.

Powell stated during a moderated talk sponsored by the Wilson Centre that “the recent data have clearly not given us greater confidence” that inflation is approaching the central bank’s 2% target. It appears, instead, “that it is likely to take longer than expected to achieve that confidence,” the speaker stated.

“At this point, it makes sense to give restrictive policy more time to work and let the data and the evolving outlook guide us, given the strength of the labour market and the progress on inflation thus far,” the Fed chairman stated.

Following the Fed’s aggressive rate-hiking campaign two years ago, interest rates are currently sitting at a 23-year high. Although inflation has significantly decreased from a four-decade high achieved in the summer of 2022, recent reports on inflation have indicated that pressure on prices for housing and services is still present.

Increased borrowing charges and rising prices for necessities have pushed many Americans to make savings. Furthermore, the housing market has all but stopped due to rising mortgage rates, despite the US economy and employment market continuing to thrive.

However, the most recent retail sales data revealed that consumers kept spending last month, providing yet another piece of evidence that the economy is still strong and the Fed is not in a rush to lower interest rates.

The US central bank is required by Congress to attain both maximum employment and stable prices, therefore it usually lowers rates whenever the economy falls significantly. There are currently no indications of a severe decline in the employment market.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations