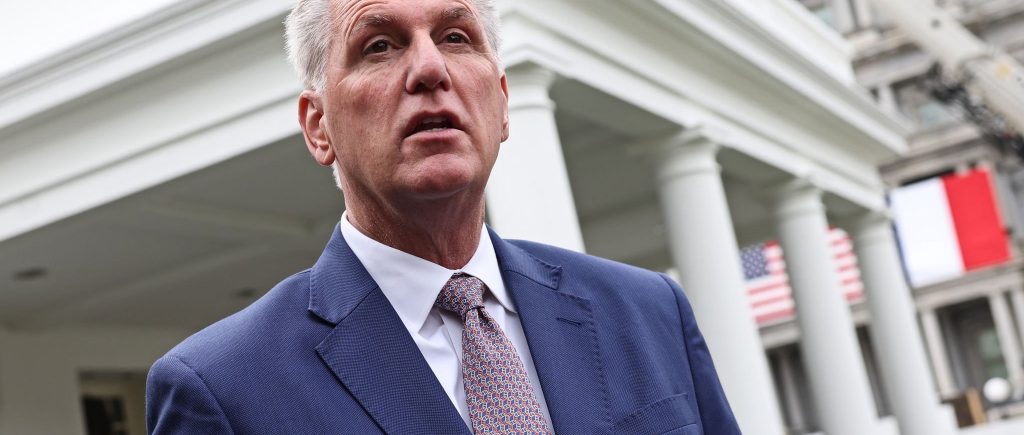

Kevin McCarthy, the California Republican, is officially the new speaker of the US House after a hot Capitol Hill drama that continued for almost four days and 15 rounds of votes.

If the House chaos for electing a new speaker had continued for weeks, the financial markets could have worried about fiscal policy uncertainty, but this could be eventually avoided.

Challenges are not over completely. One challenge does exist, namely; McCarthy will be required to run the legislation processes across the House with only a four-person majority.

US government funding goes past deadlines, leading to a funding lapse or a partial government shutdown. While the process has a significant impact on federal operations and the economy, it is nowhere near as catastrophic as a default on the debt would be.

The United States has never defaulted on its debts and just getting close to the deadline in 2011 led to a downgrade of the nation’s credit.

Moody previously warned that a default on the debt would “upend” global financial markets and the US economy.

It is a question of the US image and economic standing. Even if resolved quickly, Americans would pay for any such default for successive generations. This is because global investors would have the right to believe that the federal government’s finances are politicized and that a time may come when they would not be paid what they are owed when owed it.

The federal government spends far more money each year than it receives in revenues, which results in the famous budget deficit. Kevin McCarthy of California finally secured the House speakership in a dramatic vote ending around 12:30 a.m. Saturday, but his victory raised the risks of persistent political dilemma that may even destabilize the US financial system.

Wall Street analysts and political observers have warned that the concessions he made could make it very difficult for McCarthy to sail the boat to safety regarding America’s debt limit.

Congress could be unable to do the basic tasks of keeping the government open, paying the country’s bills and avoiding default on America’s trillions of dollars in debt.

The federal government spends more money each year than it receives in revenues, producing a budget deficit that is projected to average in excess of $1 trillion a year for the next decade. Those deficits will add to a national debt that topped $31 trillion last year.

Federal law puts a limit on how much the government can borrow. But it does not require the government to balance its budget. That means lawmakers must periodically pass laws to raise the borrowing limit to avoid a situation in which the government is unable to pay all of its bills.

Goldman Sachs researchers estimate Congress will likely need to raise the debt limit sometime around August to stave off such a scenario.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations