As highlighted in the previous technical report, the EUR/USD pair successfully reached the bearish target at 1.1575, recording a session low of 1.1557.

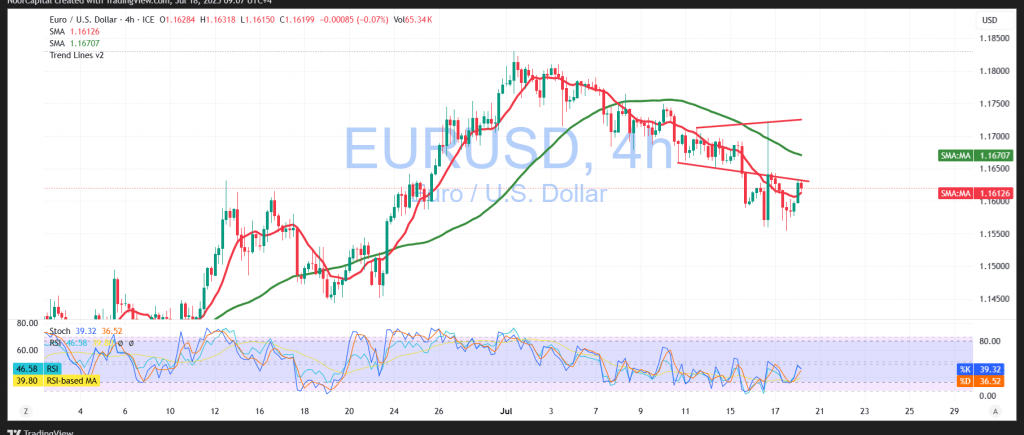

Technical Outlook – 4-Hour Timeframe:

Intraday movements indicate limited rebound attempts, following a temporary halt in selling pressure at the 1.1575 support level. The pair is currently holding above the psychological barrier of 1.1600, while the 50-period Simple Moving Average (SMA) continues to apply downward pressure from above. Meanwhile, the Relative Strength Index (RSI) is nearing overbought territory, suggesting that any upside may be short-lived or capped in the near term.

Most Likely Scenario – Bearish Bias:

As long as the price remains below 1.1665, the corrective bearish trend is expected to continue.

- A confirmed break below 1.1600 would reinforce the downside bias, with the next support levels seen at:

- 1.1575 (initial target)

- 1.1520 (subsequent support)

Alternative Scenario – Momentum Shift:

If the pair breaks and sustains above 1.1665, this may signal a shift in momentum toward the upside. In that case, the pair could target:

- 1.1690 (first resistance)

- 1.1730 (major resistance)

Caution:

Risk remains elevated amid ongoing trade and geopolitical tensions. Volatility is likely, and traders are advised to employ proper risk management strategies, as all scenarios remain possible.

Warning: Trading CFDs carries risk. This analysis is not a recommendation to buy or sell, but an illustrative interpretation of chart movements.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations