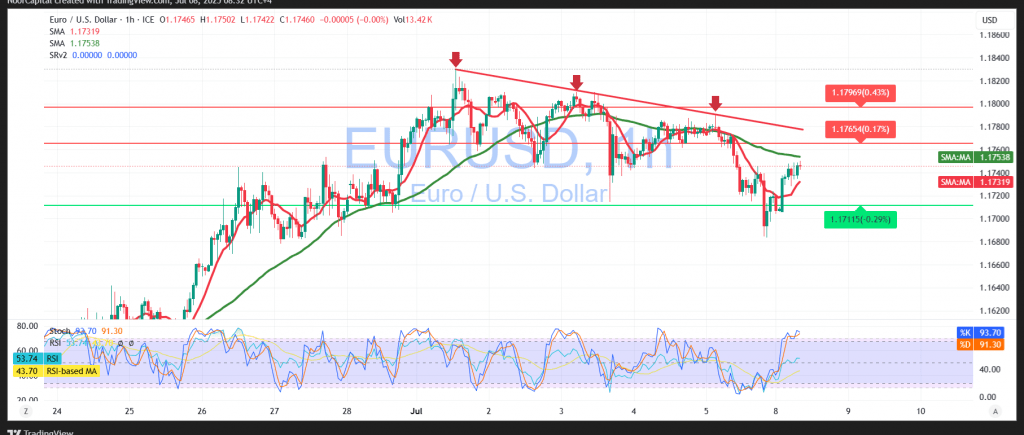

The EUR/USD pair continues to trade within a well-defined upward trajectory, edging closer to the key psychological resistance at 1.1800, with a session high recorded at 1.1790.

Technical Outlook – 4-Hour Chart:

Price action indicates strong resistance near the 1.1800 threshold, which has prompted some intraday pullbacks. Additionally, the 50-period simple moving average is beginning to act as a dynamic resistance level. The Relative Strength Index (RSI) is showing signs of weakening, suggesting potential for a short-term corrective move as the pair exits overbought territory.

Probable Scenario – Temporary Pullback:

As long as 1.1800 remains unbroken, a downward correction remains likely, with:

- 1.1690 as the first support level

- Followed by 1.1640 if bearish momentum accelerates

Alternate Scenario – Continued Upside:

A confirmed break and daily close above 1.1800 would likely reinforce bullish momentum, opening the door for:

- 1.1845 as an immediate target

- Followed by an extension toward 1.1900

Warning:

Risk levels remain elevated due to persistent trade and geopolitical tensions. All potential scenarios should be considered, and market volatility may increase unexpectedly.

Warning: Trading CFDs carries risk. This analysis is not a recommendation to buy or sell, but an illustrative interpretation of chart movements.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations