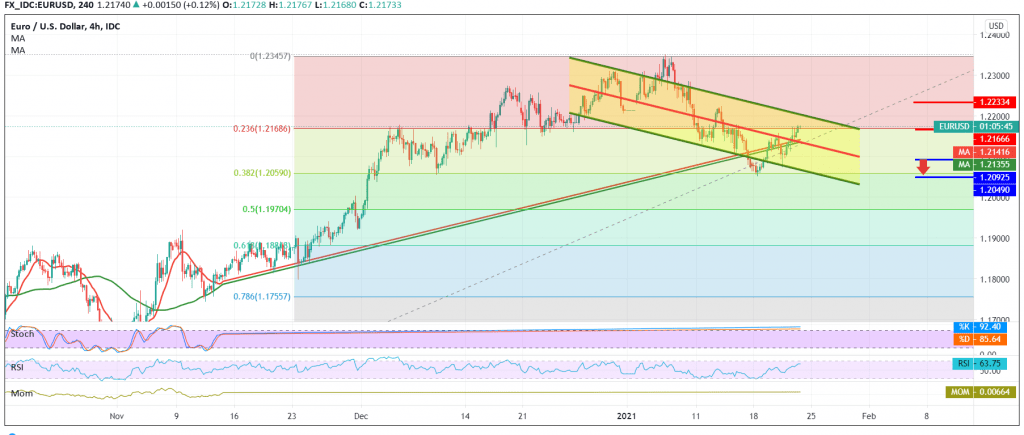

We committed to the intraday neutrality during the previous analysis due to the contradictory technical signals, to find the Euro is still trying positively within a weak bullish slope attacking the resistance level at 1.2175.

Technically, and by looking at the 4-hour interval chart, we find the simple moving averages holding the price from below. This comes in conjunction with the RSI’s attempts to obtain bullish momentum.

On the other hand, Stochastic is trading around oversold areas, in addition to trading stability below 1.2175.

With the technical signals conflicting, we will stand on the fence for the second consecutive session, waiting for the pending orders to be activated, and we will be facing one of the following scenarios:

Activating long positions needs to witness a clear and strong breach of the pivotal resistance 1.2175, represented by the 23.60% Fibonacci retracement, which increases the probability of a rally towards the first target 1.2200 and may extend later to 1.2230.

Activating short positions requires breaking 1.2120 and most importantly 1.2090, which puts the price under negative pressure targeting 1.2065 Fibonacci retracement of 38.20% and then 1.2040 / 1.2030 respectively.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations