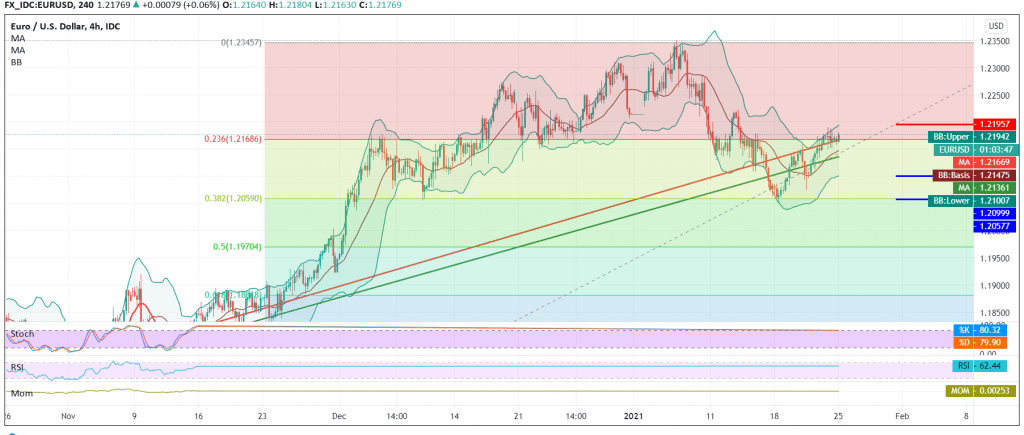

Narrow sideways trading is still dominating the euro’s movements against the US dollar, confined from the bottom above the support level of 1.2100 and from above below 1.2200.

On the technical side today, we find the pair started its weekly trading on a slight upward slope, trying to benefit from building a base on the sub-support level of 1.2150, accompanied by the clear positive signs on the RSI on short time frames.

On the other hand, the breach of the pivotal resistance 1.2175 represented by the 23.60% Fibonacci retracement has not been confirmed, and we find the stochastic is still sending negative signals. With the technical signals conflicting, we will stand on the fence for the second consecutive session, waiting for the pending orders to be activated waiting for one of the following scenarios.

Activating long positions, we need to see stability above 1.2150 and in general above 1.2110, in addition to confirming the breach of 1.2175 and stability above it, which increases the probability of hitting 1.2200 the first target and then 1.2230, respectively.

Activating short positions requires confirmation of a break of 1.2120, which puts the pair under negative pressure, and its initial target is around 1.2065 Fibonacci retracement of 38.20%.

| S1: 1.2155 | R1: 1.2200 |

| S2: 1.2110 | R2: 1.2230 |

| S3: 1.2065 | R3: 1.2270 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations