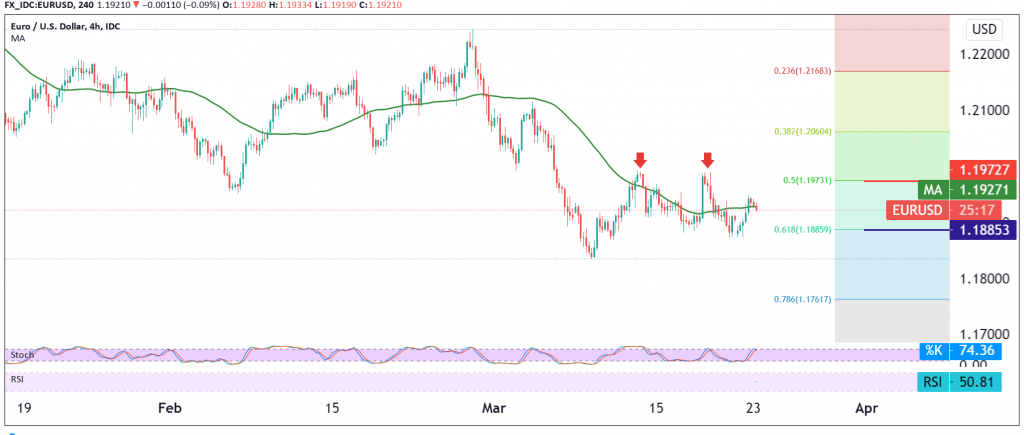

Quiet trading dominated the moves of the euro against the US dollar during the previous trading session, to find the pair a good support floor around 1.1880 within limited upside attempts to target a re-test of 1.1950.

On the technical side today, and with a closer look at the 60-minute chart, we find the 50-day moving average trying to push the price up, accompanied by the stability of the RSI indicator above the 50 midlines.

Moving to the 4-hour time frame, we find the stochastic is still negative. From here, with the conflict of technical signals, in addition to trading receding from the bottom above 1.1880 and from the top below 1.1975, we will intraday stand on the fence in order to obtain a high-quality deal and waiting for the one of following scenarios.

Activation of short positions depends on confirming the break of 1.1885 / 1.1880 Fibonacci 61.80%, which forces the pair to touch 1.1800 official stations.

Long positions requires us to witness a clear and strong breach of resistance at 1.1975, retracing 50.0%, to enhance the chances of an upside move towards 1.2000 and then 1.2035.

| S1: 1.1880 | R1: 1.1955 |

| S2: 1.1840 | R2: 1.2000 |

| S3: 1.1800 | R3: 1.3035 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations