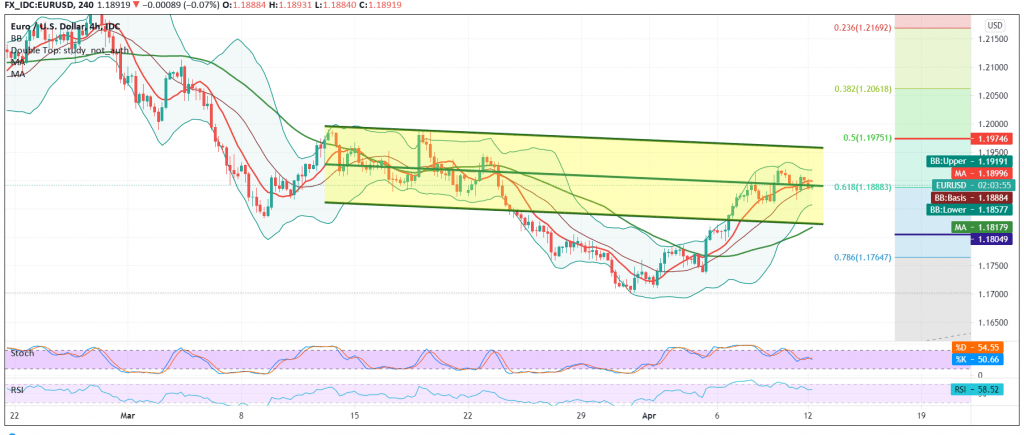

Narrow-range sideways trading took control of the euro’s movements against the US dollar, with the conclusion of last week’s trading sessions confined from the bottom above 1.1865 and the top below 1.1925.

On the technical side today, and with a closer look at the 4-hour chart, we find the conflict between the positive motive of the 50-day moving average that continues to conflict with the negative signs of the stochastic indicator, which coincides with the negative signs of the RSI on short intervals.

Despite the aforementioned inconsistency, we tend to be negative, with intraday trading remaining below 1.1885/1.1890 Fibonacci retracement 61.80%, knowing that trading below 1.1865 facilitates the task required to re-test the 1.1800 awaited target.

Confirmation of the breach of 1.1925 and the most important 1.1935 is a catalyst increases the probability of visiting 1.1975 a 50.0% retracement.

| S1: 1.1850 | R1: 1.1935 |

| S2: 1.1800 | R2: 1.1965 |

| S3: 1.1765 | R3: 1.2000 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations