Negative trading dominated the movements of the EUR/USD pair during the previous trading session after the US inflation data, which led the US dollar to rise.

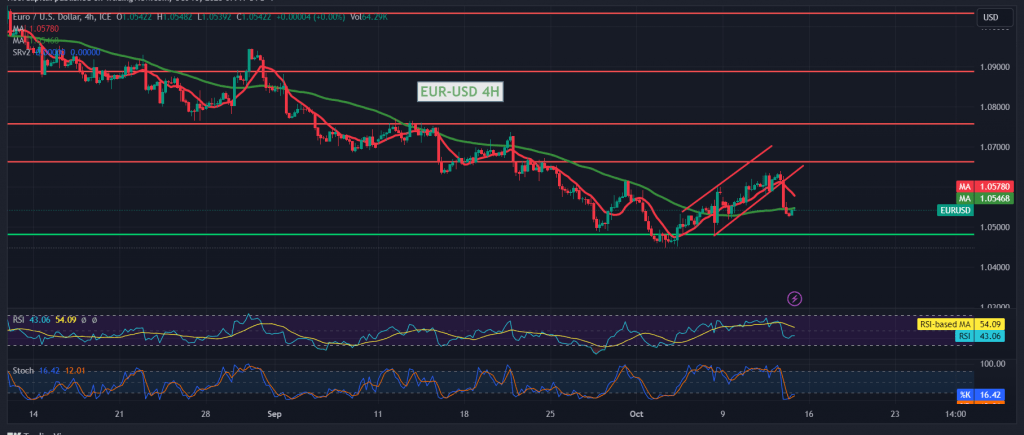

On the technical side, the euro witnessed immediate stability below the support level of 1.0550, indicating that sneaking below the mentioned level may force the pair to retest 1.0500, recording its lowest level of 1.0525, and with a closer look at the chart with a time interval of 240 minutes, we find that the 50-day simple moving average began to put pressure on The price is from below, in addition to the stability of intraday trading below 1.0550. On the other hand, we find the Stochastic indicator around the oversold areas, accompanied by trading stability above the psychological barrier support at 1.0500.

With conflicting technical signals, we prefer to monitor the price behavior of the pair to be faced with one of the following scenarios:

Breaking the strong support floor at 1.0500 puts the pair under strong negative pressure as we await 1.0450/1.0460 as a first target, and the losses may extend later to visit 1.0380.

They are breaking upwards and the price is consolidating above 1.0600. From here, the temporary upward trend returns with a target of 1.0680, and gains may extend towards 1.0740.

Note: Today we are awaiting high-impact economic data issued by the US, “Preliminary Consumer Confidence Reading – Michigan,” and from the UK, we are awaiting a speech by the president of the Bank of England, and we may witness high fluctuation in prices at the time the news is released.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations