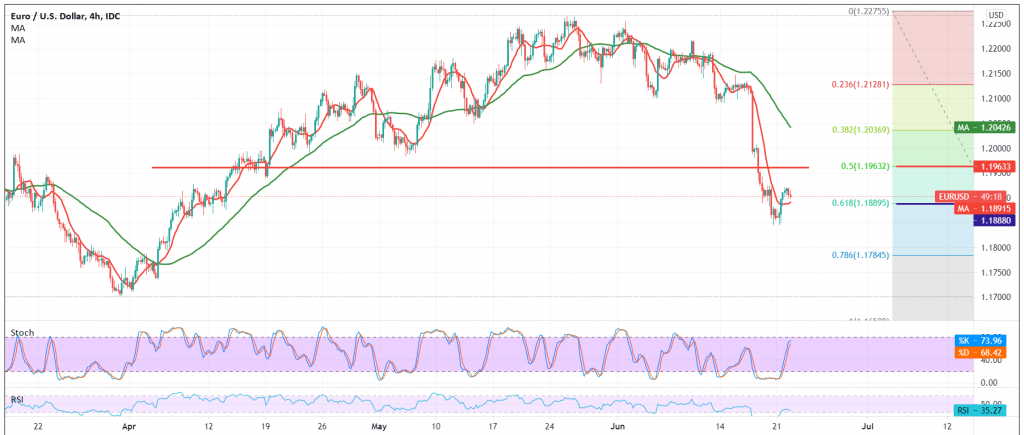

Positive attempts by the euro against the US dollar, but still limited positivity, within the euro’s attempts to restore the bullish path temporarily, benefiting from the consolidation at the 1.1880 support level.

Technically, and by looking at the 60-minute chart, we find the 50-day moving average trying to push the price to the upside, accompanied by the stability of the RSI above its mid-line.

On the other hand, we find that the negative signs are still dominating the stochastic indicator. We may witness a slight bullish bias in the coming hours, with the aim of retesting 1.1965/1.1975 before retracing again.

Note:

The slight bullish slope does not contradict the bearish trend. It should be noted that the pair’s failure to maintain its trades above the 1.1880 level, the 61.80% Fibonacci correction, as shown on the chart, will stop any attempts to rise mentioned above and lead the pair to the official descending path with a target of 1.1820 and extending later towards 1.1765.

| S1: 1.1880 | R1: 1.1935 |

| S2: 1.1820 | R2: 1.1975 |

| S3: 1.1765 | R3: 1.2010 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations