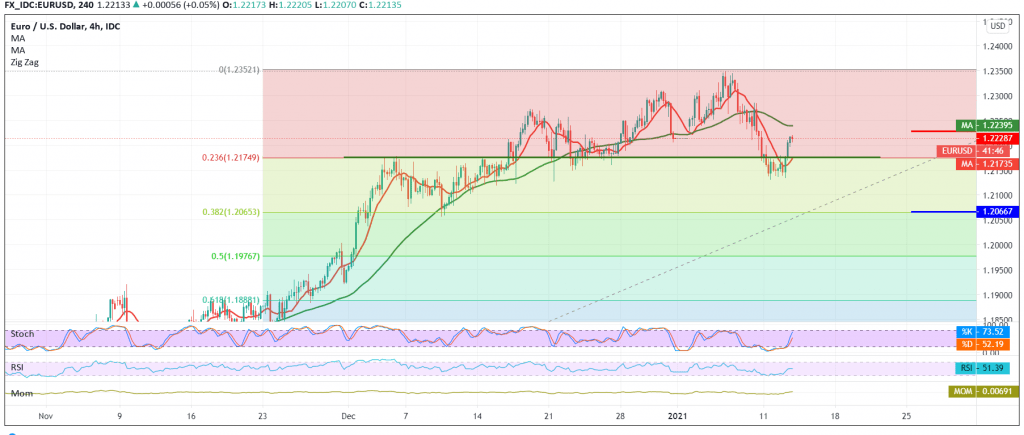

The current movements of the euro are witnessing a slightly bullish bias, benefiting from building a base on the support floor of 1.2130, as part of attempts now to retest the resistance level at 1.2230.

On the technical side, and with a closer look at the 240-minute chart, we find the pair is stable above 1.2170 Fibonacci retracements of 23.60% in addition to the positive signs coming from the RSI, all of which that supporting the upside, on the other hand, the 50-day moving average remains as an obstacle. Continuing the pressure on the price from the top, accompanied by the gradual loss of the bullish momentum on stochastic. Although we tend to be negative in our trades, we prefer to wait due to the conflict of technical signals, and we will stand on the fence for a moment to waiting for one of the following scenarios:

The bullish bias requires confirmation of the breach of 1.2230, which may enhance the chances of a bullish move towards 1.2260 / 1.2265, and the gains may extend later to visit 1.2300.

Activating short positions needs to witness a clear break and stability of the price again below 1.2170, a 23.60% correction, which puts the price under negative pressure with the first target of 1.2130 knowing that the last break extends the pair’s losses so that the way is open directly towards 1.2065 correction 38.20%, a next official station.

| S1: 1.2165 | R1: 1.2230 |

| S2: 1.2110 | R2: 1.2260 |

| S3: 1.2065 | R3: 1.2305 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations