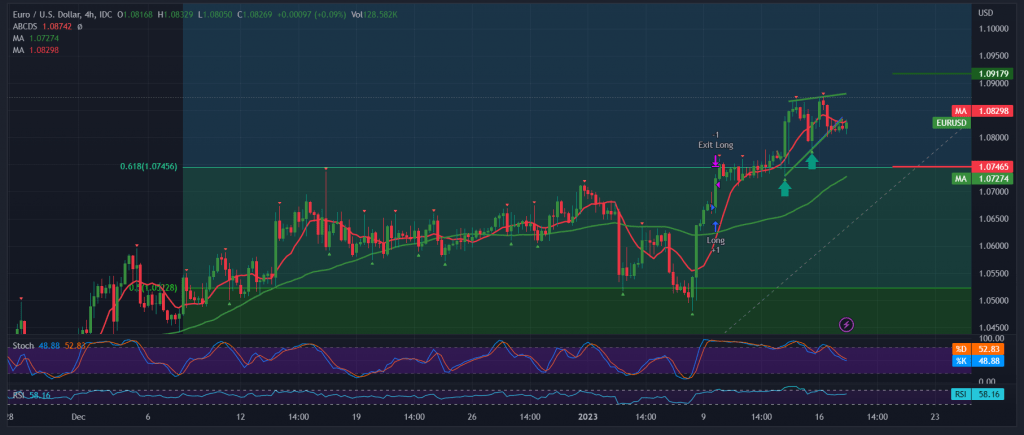

Movements tending to be positive were quiet during the US markets holiday, for the EUR/USD pair to benefit from the support level of 1.0780, trying to maintain the bullish context, as the current movements witness intraday stability above the psychological barrier of 1.0800.

Technically, and by looking at the 240-minute chart, we notice the pair’s stability above the 50-day simple moving average, which continues to provide a positive motive in support of the bullish price curve, in addition to Stochastic’s attempts to get rid of the current negativity.

From here, with steady intraday trading above 1.0780, and in general, above the strong support floor at 1.0745, the scenario remains valid, targeting 1.0870 as the first target, and breaching it opens the way for the pair to touch the official target of 1.0920.

The decline below 1.0745, the Fibonacci correction of 61.80%, might stop the suggested scenario and put the pair under negative pressure, aiming to retest 1.0675 before making it possible to rise again.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.0780 | R1: 1.0870 |

| S2: 1.0730 | R2: 1.0920 |

| S3: 1.0675 | R3: 1.0970 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations