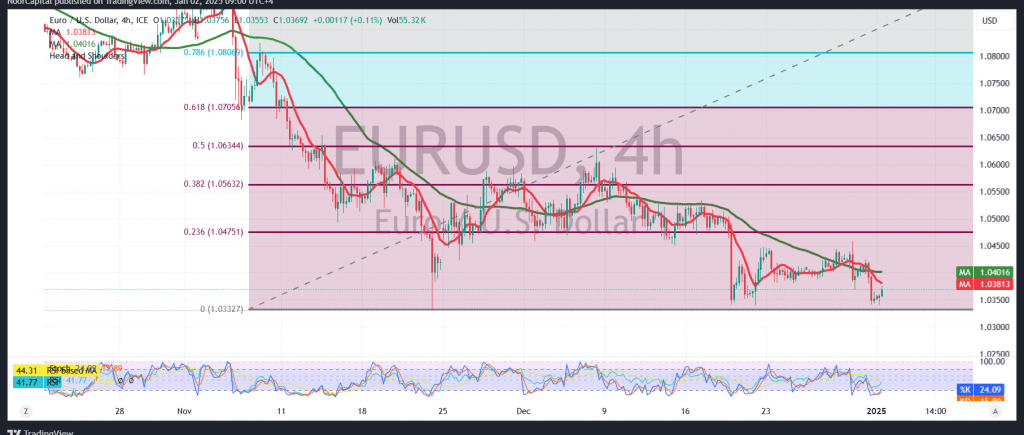

The EUR/USD pair concluded last year’s trading with predominantly negative performance, aligning with the bearish scenario outlined in the previous technical report. The pair came within a few points of the anticipated target at 1.0330, reaching a low of 1.0340.

Technical Overview:

In today’s session, the pair attempted a limited upward correction, supported by positive signals from the Stochastic indicator on the 4-hour chart. However, the simple moving averages continue to reinforce the broader bearish trend on the daily time frame.

Given the pair’s inability to sustain trading above the 1.0385 level—and more importantly, below the critical resistance at 1.0410—the bearish outlook remains dominant. A break below 1.0335 would pave the way for further declines, with the next targets set at 1.0295 and subsequently 1.0250.

On the flip side, breaching the 1.0410 resistance level could invalidate the bearish scenario, potentially signaling a recovery toward 1.0460 and 1.0490 as initial upside targets.

Risk Considerations:

It’s important to note the heightened risk environment driven by ongoing geopolitical tensions, which may lead to volatile and unpredictable price movements. Caution is advised as all scenarios remain plausible.

Risk Alert: Market conditions remain highly uncertain due to ongoing geopolitical tensions, and multiple outcomes are possible.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations