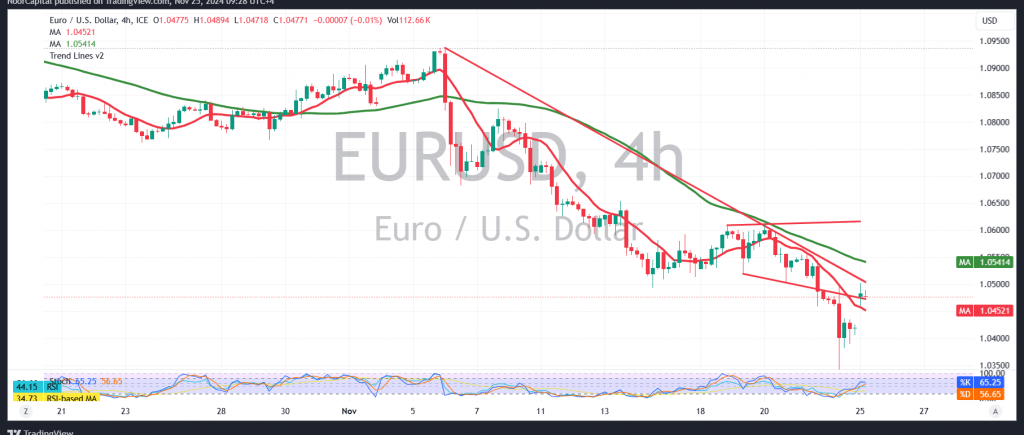

The EUR/USD pair attempted a recovery after several sessions of decline, hitting a low of 1.0330 before opening today’s trading with an upward gap.

Technical Outlook:

- Indicators: The 4-hour chart reveals negative crossover signals from the Stochastic indicator, now in the overbought zone, coupled with continued downward pressure from the simple moving averages.

Bearish Scenario:

- A break below 1.0330 would likely reinforce the downward trajectory, targeting 1.0270 initially. If bearish momentum persists, losses could extend further to 1.0205.

Bullish Reversal:

- Conversely, surpassing the 1.0510 resistance level, and more critically 1.0540, would signal potential recovery. In such a case, the pair could aim for 1.0610 as the next target.

Warnings:

Geopolitical Tensions: Current geopolitical uncertainties may lead to unpredictable scenarios, necessitating cautious trading decisions.

Risk Level: Market conditions remain highly volatile, and risks are elevated.

Risk Alert: Market conditions remain highly uncertain due to ongoing geopolitical tensions, and multiple outcomes are possible.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations