The EUR/USD pair traded within a narrow sideways range during the previous session, with limited attempts to generate short-term gains amid subdued momentum.

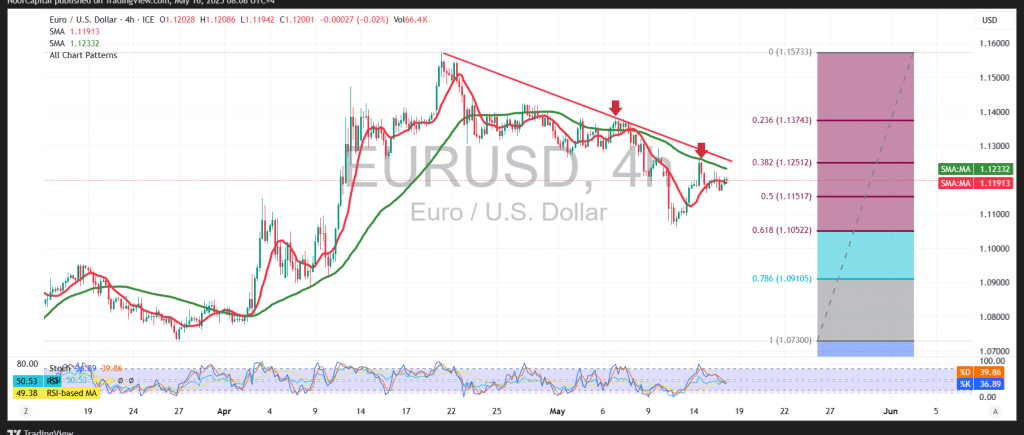

From a technical perspective, the 4-hour (240-minute) chart shows the pair continuing to trade below the 50-period simple moving average, which is acting as a firm resistance near the 1.1250 level. Additionally, the Relative Strength Index (RSI) continues to issue bearish signals, reinforcing the current downward bias.

In this context, the prevailing outlook remains tilted toward the continuation of the downward corrective trend. The immediate target is 1.1150, aligning with the 50.0% Fibonacci retracement level. A confirmed break below this area would likely extend the decline, exposing the pair to further downside toward the next key support at 1.1100.

However, a break and sustained consolidation above the 1.1255 resistance—corresponding with the 38.2% Fibonacci retracement—would likely negate the bearish scenario. In such a case, the pair may attempt a recovery, with upside targets at 1.1310 and 1.1350.

Risk Disclaimer:

With ongoing global trade tensions and broader macroeconomic uncertainty, market risk remains elevated. Traders should exercise caution and be prepared for multiple possible outcomes.

⚠ Risk Warning: The market remains highly volatile, and all scenarios should be considered.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations