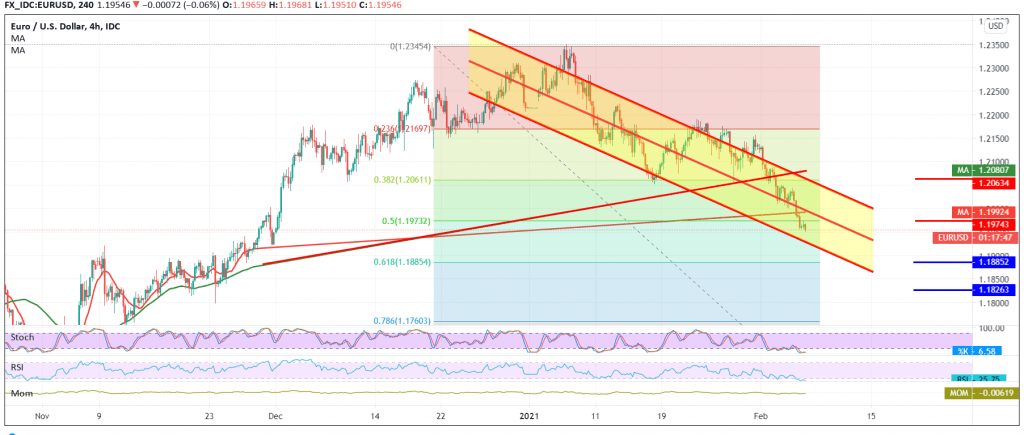

The euro declined significantly against the US dollar, continuing the downward correction as we expected during the previous analysis, touching the official target to be achieved at 1.1970, to record its lowest level during the Asian session for the current session at 1.1952.

Technically speaking, and with the pair’s failure to maintain trading above 1.1970 represented by the 50.0% correction, in addition to the continuation of the negative pressure coming from the simple moving averages.

This increases the probability of continuing the decline to visit 1.1885, Fibonacci retracement of 61.80%, as shown on the chart. The price behavior of the pair should also be monitored, because if the aforementioned level is broken, that will force the pair to incur more losses towards 1.1830.

From the top, the return of trading to stability once again above the previously broken support, which is now converted into a resistance level, according to the concept of role-swapping at 1.2020, which will stop the bearish scenario and we may witness a retest of 1.2065 before continuing to decline again.

Note: US jobs data and average wages are due today, and we may witness high volatility.

| S1: 1.1920 | R1: 1.2010 |

| S2: 1.1890 | R2: 1.2065 |

| S3: 1.1830 | R3: 1.2105 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations