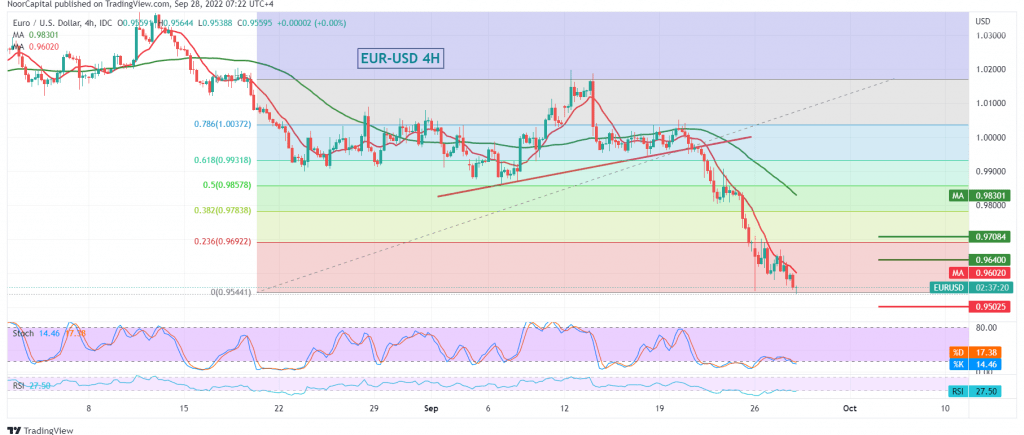

The single European currency continues to crawl negatively against the US dollar within the bearish directional movement and within the expected bearish context yesterday, touching the first target to be achieved at 0.9550, recording its lowest level during the morning trading of the current session at 0.9542.

Technically, today, and by looking at the 4-hour chart, we notice the negative pressure of the simple moving averages, which supports the continuation of the bearish price curve and is motivated by the negative signals coming from the 14-day momentum indicator.

Therefore, the bearish scenario remains the most probable, complementing the second target of the previous report, 0.9500/0.9510, and the price behavior of the pair must be monitored well around this level because breaking it forces the pair to continue the descending wave towards 0.9465 initially. It may extend later towards the 0.9400 areas as long as the price is intraday stable below 0.9640 and generally below 0.9710.

Note: We are awaiting the Federal Reserve’s speech later in today’s session and may witness high price volatility.

Note: Markets are still unstable, and we may see random moves.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 0.9510 | R1: 0.9640 |

| S2: 0.9465 | R2: 0.9720 |

| S3: 0.9385 | R3: 0.9775 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations