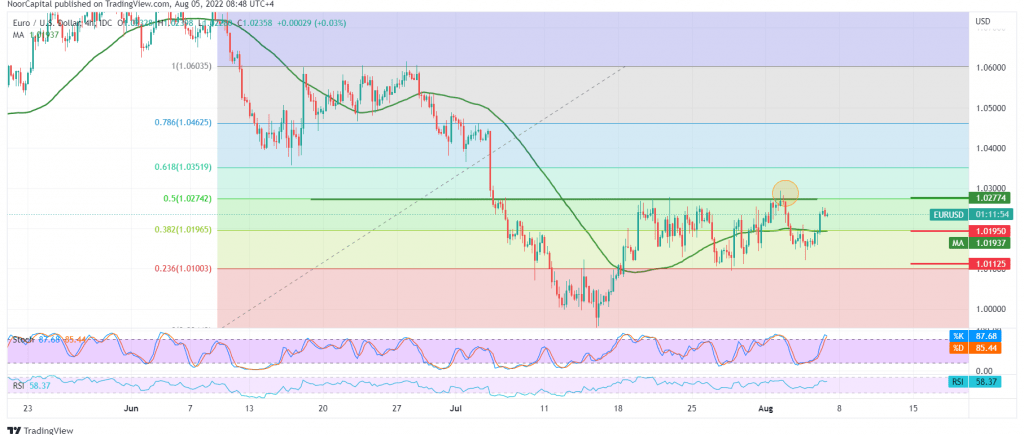

A positive trading session witnessed the movements of the euro against the US dollar within the expected bullish bias during the previous analysis, touching the retest target that is required to be achieved over the short time intervals at 1.0210, recording the highest level at 1.0253.

Technically, we find the current intraday movements stable above the 1.0200 support level after the euro established an excellent support floor at 1.0150. Furthermore, with careful consideration on the 4-hour chart, we find the 50-day simple moving average that supports the bullish price curve, accompanied by the coherence of the indicator Momentum 14 days above the mid-line.

The daily trend tends to the upside, but it is confirmed only by breaching the pivotal resistance 1.0275, represented by the 50.0% Fibonacci correction, which is a catalytic factor that enhances the chances of touching 1.0310 and 1.0350, respectively, as long as the price is stable above 1.0150.

The decline below 1.0150 can thwart the above-suggested scenario, and the EUR/USD pair is witnessing a bearish tendency, with its initial target of 1.0115, and it may touch 1.0075.

Note: Today, we are waiting for high-impact data from the US economy, jobs data, unemployment rate and average wages,” and we may witness high price fluctuations.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.0175 | R1: 1.0275 |

| S2: 1.0115 | R2: 1.0315 |

| S3: 1.0070 | R3: 1.0375 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations