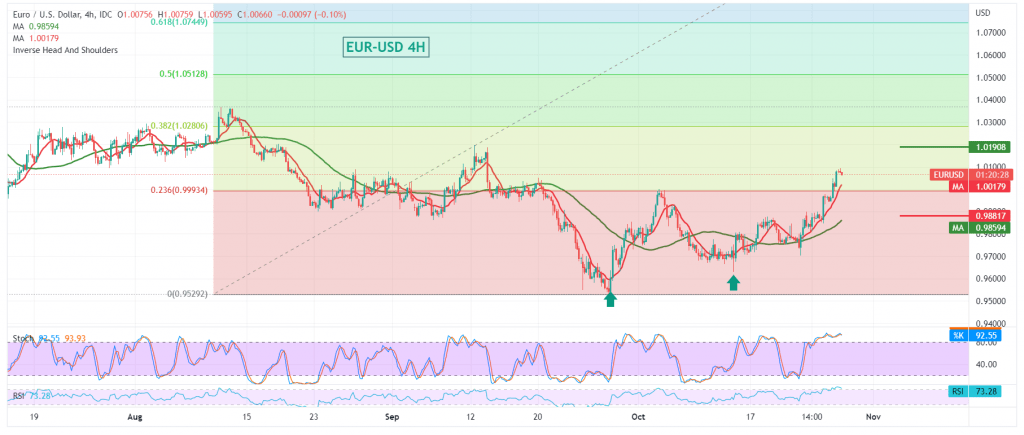

An upward trend dominated the euro’s movements against the US dollar yesterday, within the expected positive outlook during the previous analysis, touching the official target station at 1.0050, recording the highest level at 1.0093.

Technically, the simple moving averages continue to support the daily bullish curve for prices and the bullish technical structure shown on the 240-minute chart.

Therefore, we maintain our positive expectation, and the bullish bias is more likely during the day, targeting 1.0130 first target, knowing that its breach increases and accelerates the strength of the daily bullish trend, opening the door towards 1.0185, and gains may extend later towards 1.0230.

Activating the above suggested bullish scenario requires stability of daily trading above 1.0000 and, most importantly 0.9980, and breaking it will immediately stop the attempts to rise and put the pair under strong negative pressure, targeting retesting 0.9880 initially.

Note: The euro rate decision and European Central Bank press conference are due today. They have an important impact, and we may witness high price volatility and erratic movements.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 0.9980 | R1: 1.0130 |

| S2: 0.9885 | R2: 1.0185 |

| S3: 0.9805 | R3: 1.0280 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations