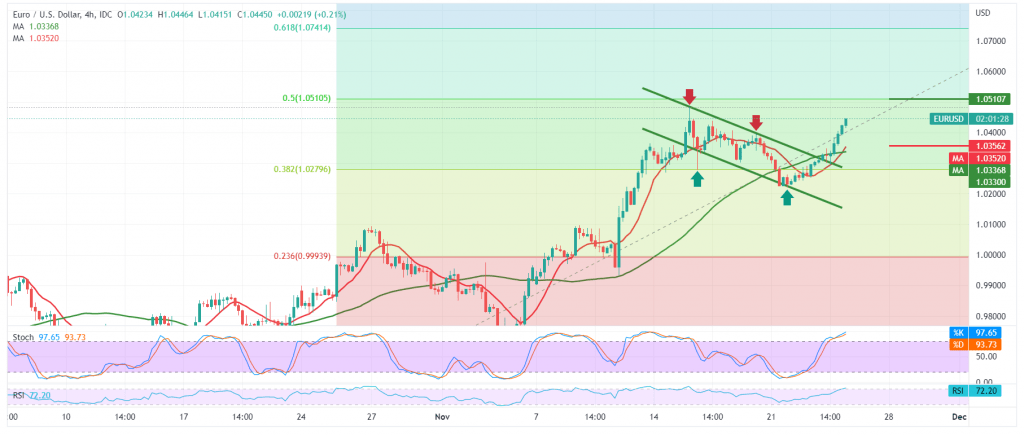

A positive trading session that witnessed the movements of the Euro-dollar pair within the expected bullish path during the last analysis, explaining that the breach to the upside and the consolidation above the resistance level of 1.0350 is a motivating factor that enhances the chances of touching our required target 1.0435, for the pair to record its highest level during the early trading of the current session 1.0444.

Technically, and by looking closely at the 4-hour chart, we find the simple moving averages support the continuation of the bullish daily price curve, which comes in conjunction with the pair continuing to receive bullish momentum signals from the 14-day momentum indicator.

From here, with steady daily trading above the previously breached resistance level, which is now transformed into 1.0345 support, the bullish scenario remains valid and effective, targeting 1.0495 as the first target and then 1.0520 around 50.0% Fibonacci correction, as shown on the chart.

Note: US markets are on holiday due to Thanksgiving, and volumes are light

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.0345 | R1: 1.0495 |

| S2: 1.0250 | R2: 1.0540 |

| S3: 1.0195 | R3: 1.0640 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations