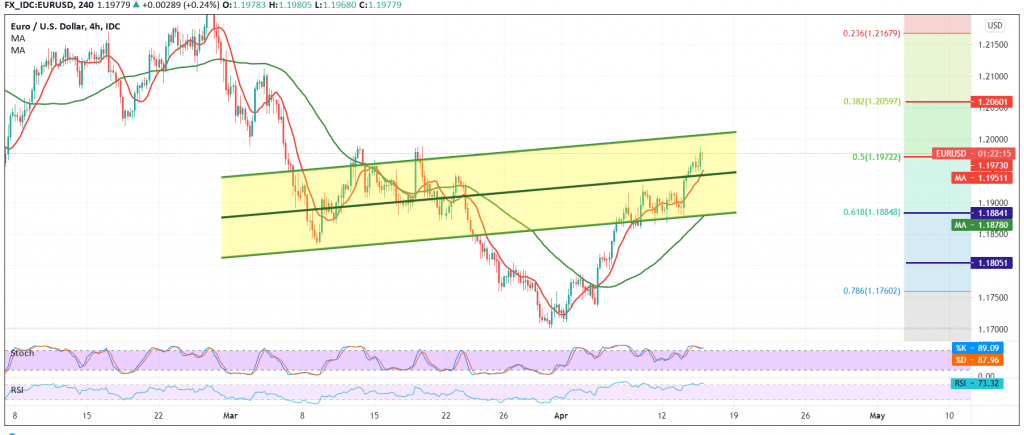

Positive trading dominated the euro against the US dollar so that the pair could touch the official target station during the previous analysis at 1.1975, recording a high of 1.1987.

Technically, we find the current moves are witnessing stability above the psychological barrier of 1.1900, and we find the 50-day moving average continues to hold the price from below and meets around the support level of 1.1880, Fibonacci retracement of 61.80%, in addition to the RSI indicator continuing to provide positive signals.

Therefore, we believe that there is a possibility to continue the bullish bias, provided that the breach of 1.1975 is confirmed to facilitate the task required to visit 1.2010 / 1.2015 as a first target and gains may extend later towards 1.2060, a 38.20% retracement.

From the bottom, trading is below 1.1880, and the most important one is 1.1860 that is able to foil the suggested bullish scenario and put the price under negative pressure again, with an initial target of 1.1800.

| S1: 1.1900 | R1: 1.2015 |

| S2: 1.1840 | R2: 1.2065 |

| S3: 1.1795 | R3: 1.2125 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations