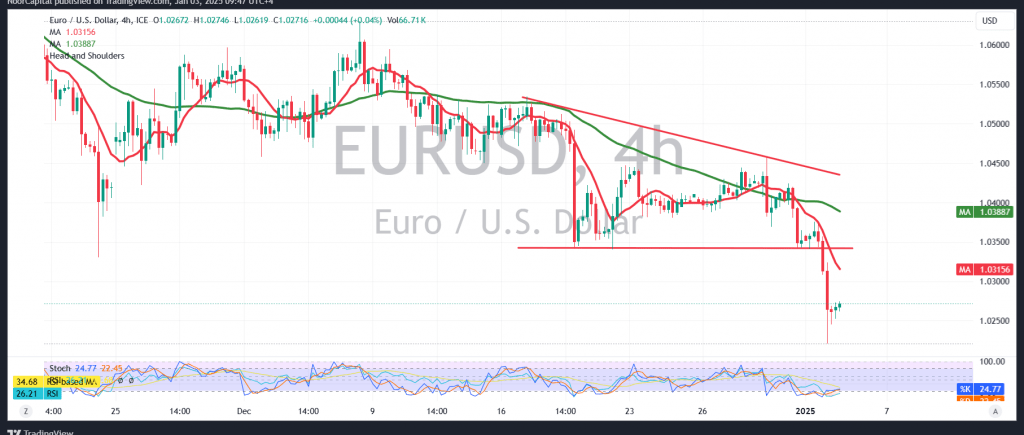

As anticipated in the previous report, the EUR/USD pair extended its strong downtrend, achieving the target of 1.0250 and marking a low of 1.0220.

Technical Outlook:

A closer look at the 4-hour chart highlights continued bearish pressure from the 50-day simple moving average. However, the Stochastic indicator is beginning to show temporary positive signals due to its entry into the oversold territory.

As long as daily trading remains below the resistance levels of 1.0325 and, more critically, 1.0360, the bearish outlook remains dominant. A confirmed break below 1.0200 would likely accelerate the downtrend, clearing the path toward the next target at 1.0140.

Alternative Scenario:

Should the pair manage to breach the resistance level of 1.0360, the bearish scenario would be invalidated. This could lead to a temporary recovery, with upside targets at 1.0445 and 1.0470, respectively.

Risk Considerations:

In light of ongoing geopolitical tensions, market volatility remains high, and all scenarios are possible. Traders are advised to exercise caution and adapt to changing market conditions.Risk Alert: Market conditions remain highly uncertain due to ongoing geopolitical tensions, and multiple outcomes are possible.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations