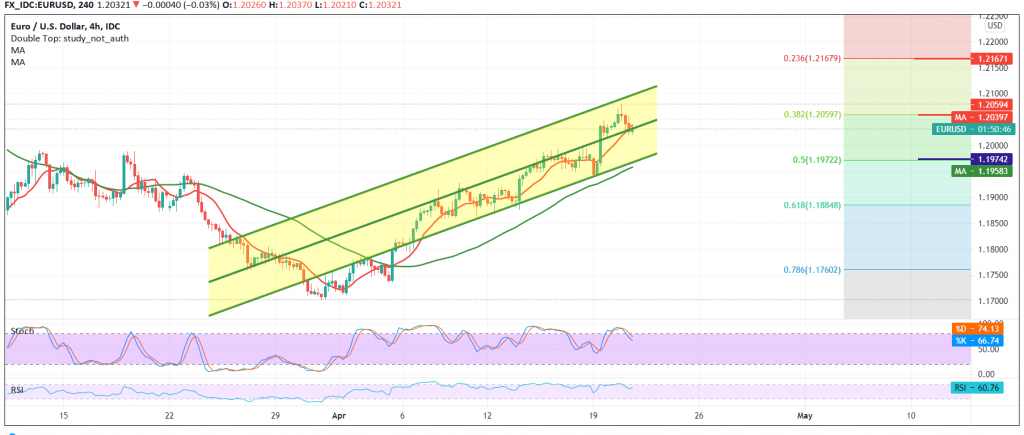

The European single currency managed to achieve the first bullish target published during the previous analysis, located at 1.2060, to record a high of 1.2080.

On the technical side, the current movements of the pair are witnessing negative pressure due to approaching the resistance of the psychological barrier of 1.2100.

With a closer look at the 60-minute chart, we find the RSI indicator is providing negative signals in addition to the stochastic losing bullish momentum.

From here, with intraday trading below 1.2060 corrections 38.20%, the euro may see a bearish tendency targeting a re-test of 1.1970 a correction of 50.0%, bearing in mind that breaking the aforementioned level may extend the negativity and lead the euro to visit 1.1900/1.1885.

Note: the bearish bias does not coincide with the general bullish trend, whose initial targets are around 1.2170, provided that the breach of 1.2100 is confirmed.

| S1: 1.1960 | R1: 1.2095 |

| S2: 1.1885 | R2: 1.2150 |

| S3: 1.1820 | R3: 1.2230 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations