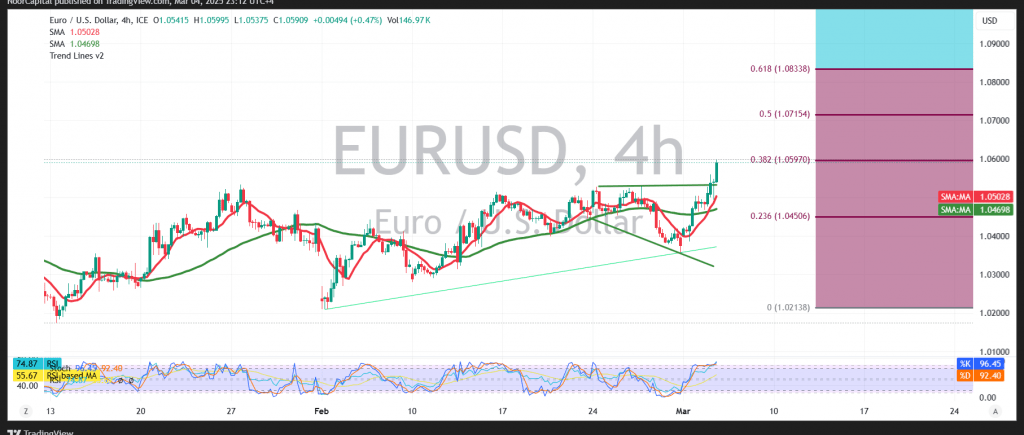

The US dollar against the US dollar reached the expected target path in the previous report, hitting its official target at 1.0540 and recording 1.0600 at the time of this report.

From today’s technical perspective, on the 4-hour chart the simple moving averages continue to provide positive momentum, while the 14-day momentum indicator supports further upward movement.

With the pair holding above the breached 1.0540 level—and generally above 1.0500—there is potential for continued gains, provided that the price breaks through the psychological barrier at 1.0600 around the 38.20% Fibonacci retracement level. If confirmed, the next target could be 1.0640, with further gains possible toward 1.0685 and 1.0715, near the 50.0% Fibonacci level.

Conversely, if the price falls back below 1.0500, the bearish scenario may resume, potentially driving the pair toward a retest of 1.0450.

Risk Warnings:

Ongoing trade tensions and other risks remain, and multiple scenarios are possible.

High-impact economic data, such as the US non-agricultural private sector report, is expected and could significantly affect market direction.

Risk Warning: Market volatility remains high amid ongoing trade tensions, and multiple scenarios are possible.

⚠ Risk Warning: The market remains highly volatile, and all scenarios should be considered.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations