The Euro managed to achieve the bearish scenario, as we expected and mentioned in the previous analysis, after it confirmed the break of 1.2085, heading directly towards the second official target of 1.2020.

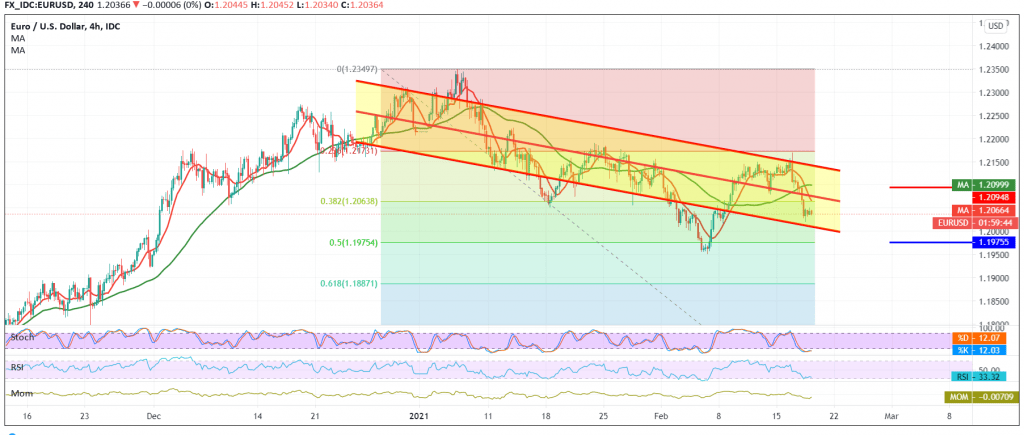

Technically speaking, and by looking at the 240-minute chart, we find the pair is stable below the support level of 1.2065 represented by the 38.20% Fibonacci correction as shown on the chart, and we also limit the 50-day moving average that continues to pressure the price from the top and meets around the support level It was previously broken and converted to the resistance level 1.2090, adding more strength to it.

From here, we will maintain our negative outlook targeting 1.2000, then 1.1970 50.0% retracement, a next official station, bearing in mind that confirming a break of 1.1970 forces the pair to continue declining towards 1.1920.

The suggested scenario requires intraday stability below 1.2065 and in general below 1.2090.

| S1: 1.2000 | R1: 1.2090 |

| S2: 1.1970 | R2: 1.2140 |

| S3: 1.1920 | R3: 1.2175 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations