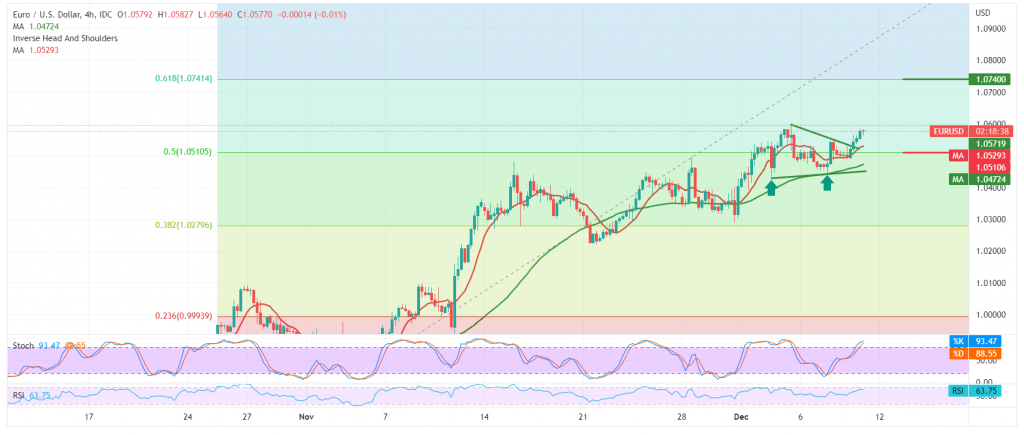

The Eurodollar pair moved positively during the previous trading session after it succeeded in activating the pending purchase order mentioned yesterday at 1.0510, explaining that this can enhance the chances of a rise towards the first target 1.0555, recording its highest level at 1.0586.

The technical side today indicates the possibility of continuing the rise, relying on the continuation of the pair obtaining a positive incentive from the simple moving averages, in addition to confirming the pair’s breach of the resistance level of 1.01510, Fibonacci correction 50.0%, and its transformation now into a support level, according to the concept of reciprocity.

Therefore, resuming the rise is the most likely today, targeting 1.0615, and then 1.0645 as a second target, taking into consideration that rising upwards for the second target extends the pair’s gains, opening the door directly towards 1.0740, the 61.80% correction.

Activating the suggested bullish scenario requires daily trading to remain above 1.0520, and most importantly 1.0480.

Note: Today we are awaiting high-impact data issued by the US economy, “the monthly producer price index and the initial reading of consumer confidence,” and we may witness high volatility in prices.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.0520 | R1: 1.1615 |

| S2: 1.0455 | R2: 1.0645 |

| S3: 1.0410 | R3: 1.0710 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations