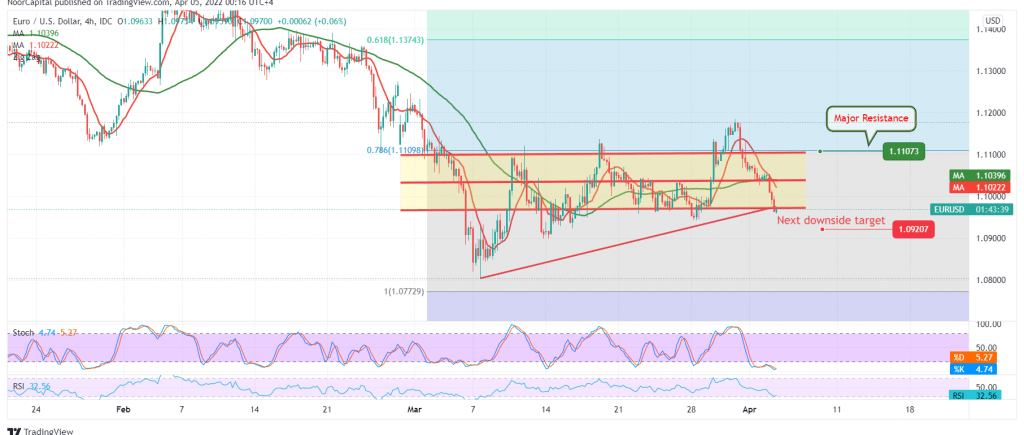

A negative trading session witnessed the euro’s movements against the US dollar within the expected bearish context with the beginning of the current week’s trading, heading towards touching the first target of 1.0970, to record the lowest at 1.0965.

Technically, we are still inclined to the negativity, relying on the price stability below the 50-day moving average, which meets around the resistance level of 1.1045 and the negativity of the 14-day momentum indicator.

Therefore, the bearish scenario will remain the most preferred, completing towards the next official target of 1.0920/1.0930, an official price station, considering that breaking the mentioned level forces the pair to extend the current descending towards 1.0885 initially.

To remind you that activating the above-suggested scenario requires the intraday trading to remain below 1.1045 and below the main supply point of 1.1100.

Note: The risk level is high.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.0925 | R1: 1.1045 |

| S2: 1.0885 | R2: 1.1110 |

| S3: 1.1810 | R3: 1.1160 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations