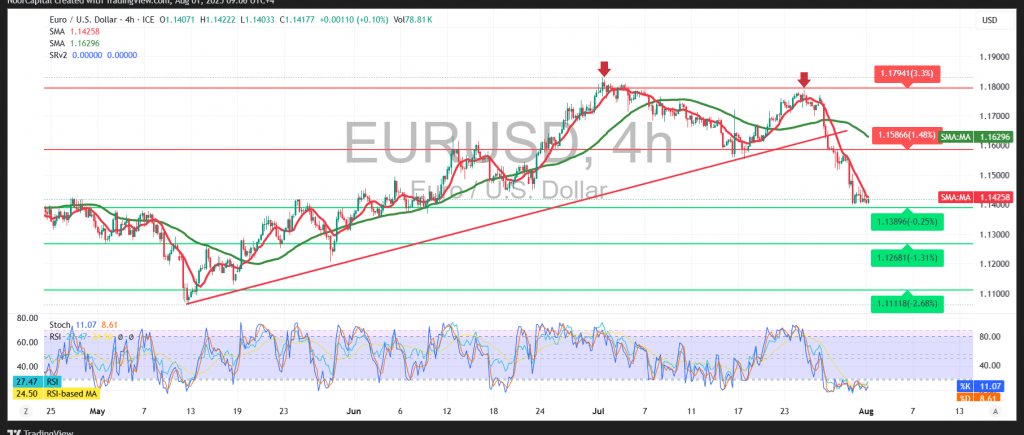

The EUR/USD pair traded within a bearish sideways range during the previous session, maintaining alignment with the prevailing negative outlook. The pair approached the key psychological barrier at 1.1400, recording its lowest level near that threshold.

Technical Outlook:

Currently, the pair is attempting a limited rebound to recover part of the recent losses. However, price action remains capped below the 50-period Simple Moving Average (SMA), which continues to serve as dynamic resistance. Additionally, the chart is beginning to reveal signs of a bearish “double top” pattern, further reinforcing downside risks. Meanwhile, the Relative Strength Index (RSI) is providing modest positive signals as it rebounds from near-oversold territory, which may temporarily slow the pace of the decline.

Probable Scenario:

As long as the price remains below the 1.1460 resistance level, the bearish outlook prevails. A confirmed break below the psychological support at 1.1400 would likely open the way for extended downside movement, targeting 1.1360 initially, followed by the next support zone at 1.1310.

Alternative Scenario:

Should the price manage to break and stabilize above 1.1460, this could shift near-term sentiment and trigger a corrective move higher, with initial upside potential toward the 1.1500 resistance level.

High-Impact Events – Volatility Expected:

Today’s session could see heightened volatility as markets await the release of key U.S. economic indicators:

- Non-Farm Payrolls

- Unemployment Rate

- Average Hourly Earnings

These data points are likely to influence dollar strength and, by extension, the EUR/USD pair.

Warning:

The risk environment remains elevated due to ongoing trade tensions and global uncertainty. All scenarios should be considered, and risk management is advised.

Warning: Trading CFDs carries risk. This analysis is not a recommendation to buy or sell, but an illustrative interpretation of chart movements.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations