We adhered to intraday neutrality during the previous analysis due to the conflicting technical signals, explaining that activating the short positions depends on the confirmation of breaking the 1.2170 support level, which puts the price under negative pressure targeting 1.2120, to move the pair in a bearish context approaching the target by a few points, recording the lowest 1.2130.

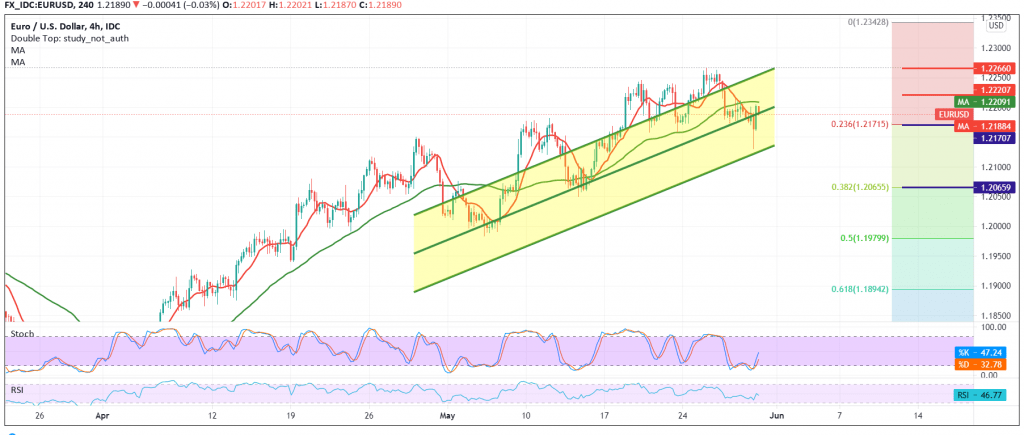

On the technical side, today the pair bounced back, seeing the current moves witnessed an intraday stability above 1.2170 Fibonacci retracement level 23.60%. There are positive crossover signs appearing on the stochastic indicator supporting the possibility of the bullish bias returning again.

On the other hand, the 50-day moving average still represents an obstacle to the pair, and it meets near 1.2210/1.2220, adding more strength to it.

Therefore, we find confusion in determining the next intraday trend, and we will stand on the sidelines to obtain a good deal, waiting for any of the following.

Trading again below 1.2170 and most importantly 1.2145 increases the possibility of continuing the decline with an initial target of 1.2095, while the official target for the break is located around 1.2065, a 38.2% correction.

Activating long positions requires a breach of 1.2225, and from here the euro recovers, targeting 1.2265 and 1.2310, respectively.

| S1: 1.2145 | R1: 1.2225 |

| S2: 1.2095 | R2: 1.2265 |

| S3: 1.2065 | R3: 1.2310 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations