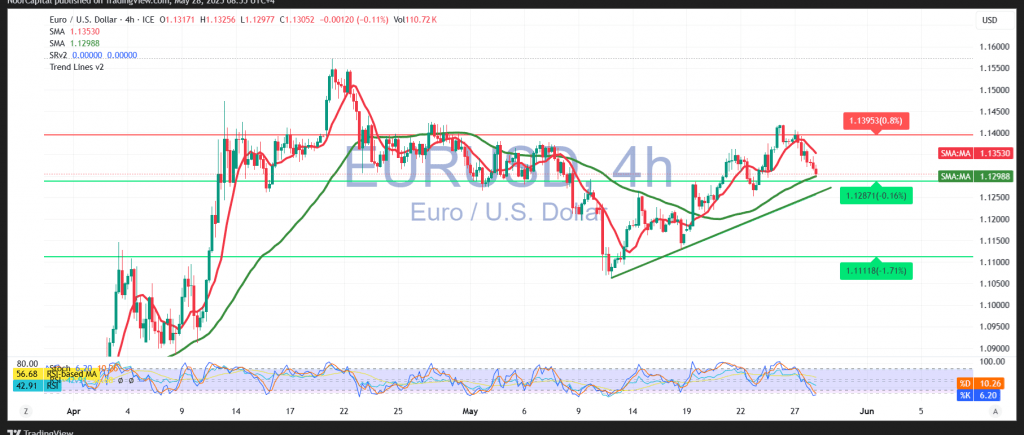

The EUR/USD pair experienced a pullback after successfully reaching the official target at 1.1410, recording a high of 1.1407 in the previous session. This rejection from the psychological resistance level has led to renewed selling pressure.

On the 4-hour chart, we see that 1.1400 remains a key resistance, as the pair failed to sustain a breakout above this level. However, intraday movements are now attempting to stabilize above the psychological 1.1300 support, which coincides with the ascending trendline. The Relative Strength Index (RSI) is also showing signs of recovery after entering oversold territory, suggesting the possibility of regaining positive momentum.

Given these factors, there is potential for a short-term rebound, with the initial upside target at 1.1350. A confirmed break and consolidation above this level could pave the way for a retest of the 1.1400 resistance zone.

Conversely, a one-hour candle close below 1.1270 would weaken the bullish outlook and expose the pair to further downside pressure, targeting 1.1230 and potentially 1.1160 in the near term.

Key Event Risk Today:

Traders should exercise caution ahead of the Federal Reserve meeting minutes release, a high-impact event that could introduce significant volatility to the market.

Risk Disclaimer:

With ongoing global trade tensions and key economic data in focus, risk levels remain elevated. Traders should remain vigilant and prepare for potential sharp price swings in either direction.

⚠ Risk Warning: The market remains highly volatile, and all scenarios should be considered.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations