The movements of the euro witnessed a noticeable increase during the previous trading session, with increasing bets that the European Central would raise interest rates and the decline of the US dollar, reaching its highest level at 1.0563.

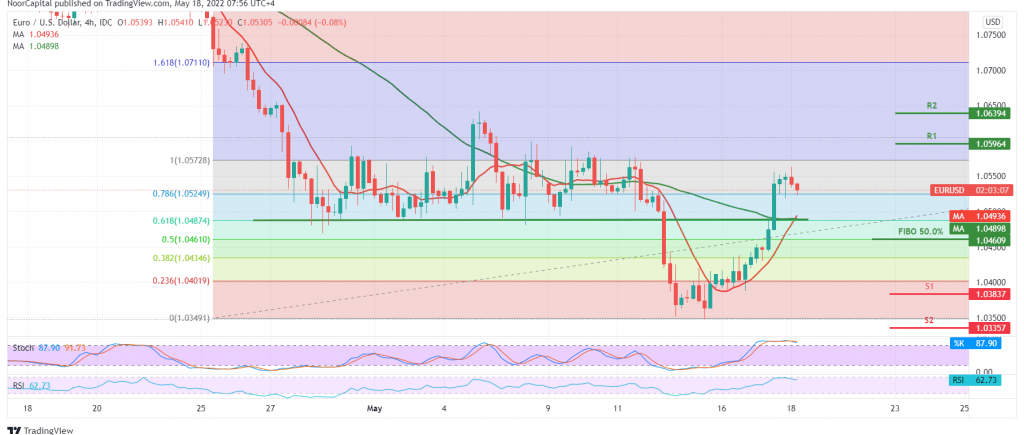

Technically, we find the euro succeeded in breaching the 1.0460 resistance level, confirming the intraday stability above the 1.0490 resistance level. With a careful look at the 4-hour chart, we find the simple moving averages returned to hold the price from below, accompanied by the positive signs of the 14-day momentum indicator on the time frames short.

With the stability of trading above the previously breached resistance-into-support level at 1.0460, represented by the 50.0% Fibonacci correction, there may be a possibility of a further rise to visit 1.0580. We should pay close attention and monitor the price behavior of the pair if the level is touched because of its importance for the general trend on an intraday basis. Its breach may enhance the pair’s gains, opening the door to 1.0640 as long as the price is stable intraday above 1.0490 and daily above 1.0460.

The return of the euro’s stability below 1.0460, the 50.0% correction, will stop the bullish bias that occurred yesterday. The pair will return to the official bearish track, whose initial targets are around 1.0370 and 1.0320, respectively.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.0450 | R1: 1.0580 |

| S2: 1.0370 | R2: 1.0640 |

| S3: 1.0315 | R3: 1.0720 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations