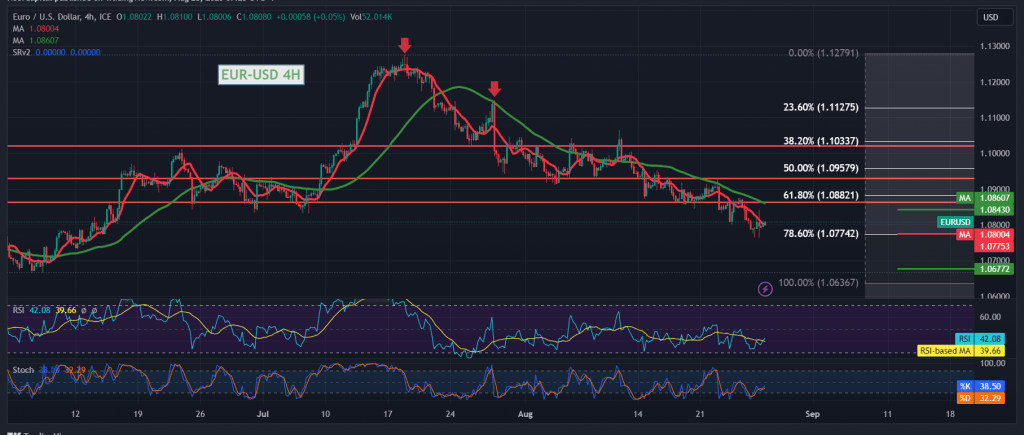

As we expected, the euro-dollar pair continues its bearish trend, recording its lowest level at the end of last week’s trading, around 1.0766, as part of attempts for a bullish rebound, to hover now around the resistance level of the psychological barrier 1.0800.

On the technical side today, and when looking closely at the 4-hour chart, we notice the continuation of the negative pressure of the simple moving averages, which support the bearish price curve. On the other hand, positive crossover signs started appearing on the stochastic indicator accompanied by intraday stability above 1.0775.

With conflicting technical signals, we prefer to monitor the price behavior of the pair to obtain a high-quality deal, to be in front of one of the following scenarios:

To resume the bearish directional movement, we need to witness a break of 1.0770, which extends the pair’s losses, as we wait for 1.0730 & 1.0675 as awaited targets.

Suppose the pair maintains the temporary positive stability above the support mentioned above, Rising above 1.0845 from here. In that case, the pair may recover from retesting the previously broken support, which became resistance at the resistance level of 1.0885, Fibonacci correction 61.80%.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations