The euro is facing renewed intraday selling pressure as the U.S. dollar attempts to stage a modest rebound.

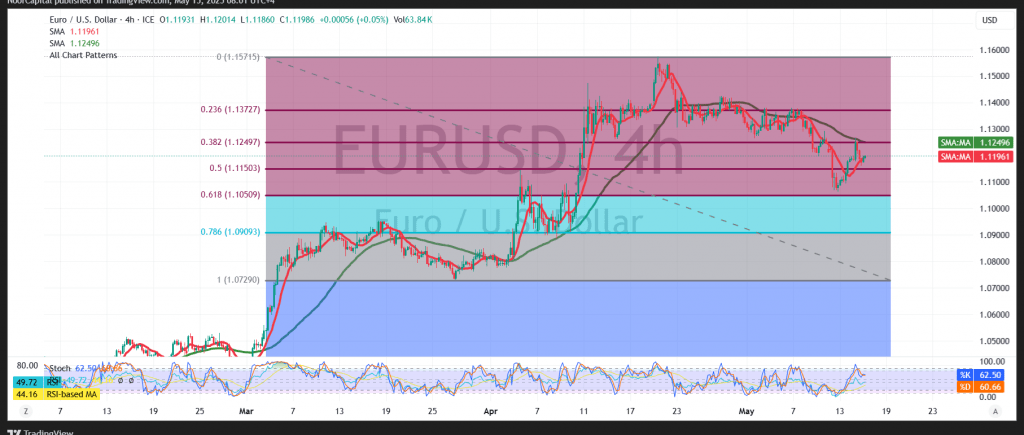

From a technical standpoint, the 4-hour (240-minute) chart shows the pair trading below the 50-period simple moving average, which is acting as strong resistance near the 1.1250 level. Additionally, the Relative Strength Index (RSI) continues to issue bearish signals, reinforcing the downside bias.

Given these conditions, the downward corrective trend remains the most likely scenario for today’s session. The next immediate target is 1.1150, with a confirmed break below this level potentially extending losses toward the 1.1100 support zone—marking the next official downside target.

Conversely, a break and sustained consolidation above the 1.1255 resistance—coinciding with the 38.2% Fibonacci retracement—could negate the current bearish outlook. In this scenario, the pair may attempt a recovery toward the 1.1310 and 1.1350 resistance levels.

Key Event Risk Today:

Several high-impact U.S. economic indicators are scheduled for release, including:

- Retail Sales

- Producer Price Index (PPI)

- Unemployment Claims

- Speech by a Federal Reserve Governor

These events are expected to drive significant volatility in the EUR/USD pair.

Risk Disclaimer: Amid ongoing global trade tensions and shifting monetary policy expectations, market risk remains elevated. Traders should be prepared for sharp price swings and multiple possible scenarios.

⚠ Risk Warning: The market remains highly volatile, and all scenarios should be considered.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations