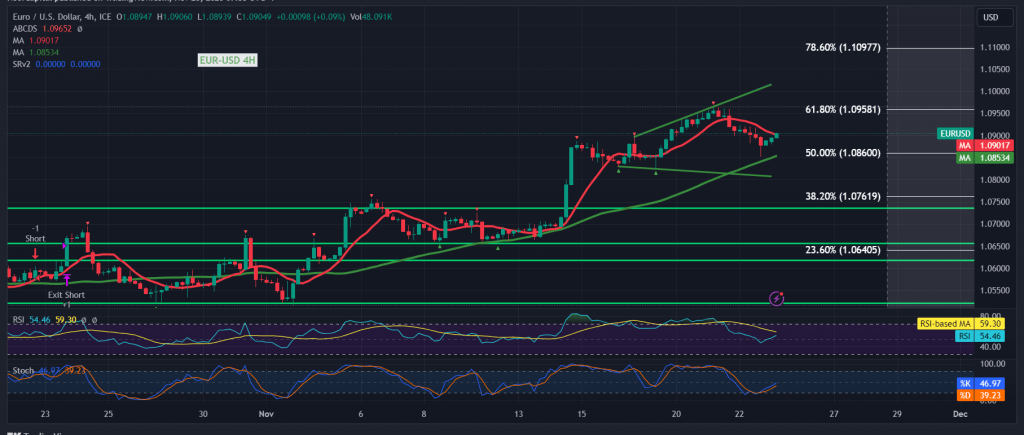

The EUR/USD pair experienced a downturn, directing trades towards a reevaluation of the key support level highlighted in the previous report at 1.0860.

In today’s technical analysis, a meticulous examination of the 4-hour time frame chart reveals a successful retest of the 1.0860 support, marked by the 50.0% Fibonacci retracement. Notably, the simple moving average converges around this critical level, reinforcing its significance. The Stochastic indicator exhibits a promising trend, displaying positive signals that bolster the potential for an upward trajectory.

As a result, the prevailing outlook leans towards an upward trend, with a target set at 1.0960, corresponding to the 61.80% Fibonacci retracement, as depicted in the chart. A breach of this level serves as a catalyst, heightening the probability of reaching 1.1000, and subsequent gains may extend towards 1.1050.

Conversely, a return to stability below 1.0860, accompanied by the closure of at least a one-hour candle, has the capacity to negate the envisioned bullish scenario, prompting a reevaluation with a retest of 1.0800 initially.

Caution is advised, given the anticipation of highly impactful economic data from the Eurozone (preliminary readings of the services and manufacturing PMI indices from France and Germany). Additionally, the United Kingdom’s economy is expected to release the preliminary readings of its services and manufacturing PMI indices, potentially resulting in heightened price volatility upon their announcement.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations