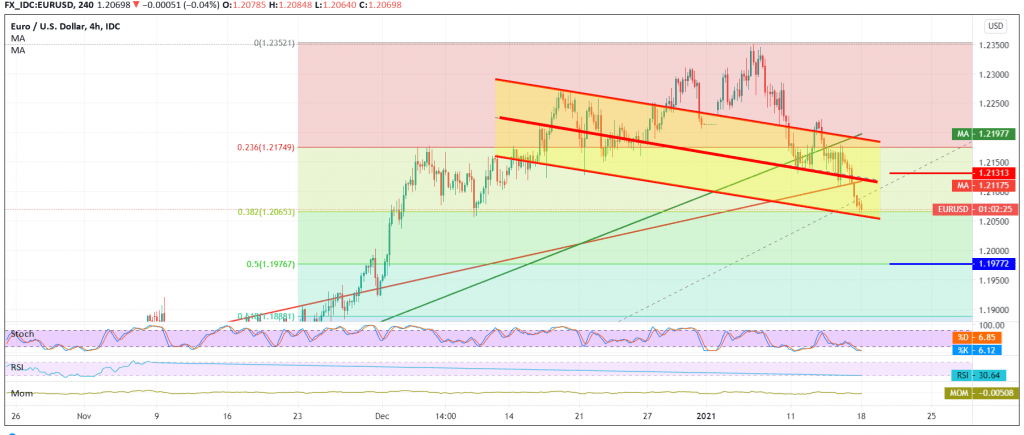

The euro is trading negatively against the US dollar in the expected bearish context, touching the official target mentioned in the previous analysis 1.2065, to hit its lowest level during early trading for the current session 1.2065.

On the technical side, the negative pressures coming from the 50-day simple moving average continue today, which is accompanied by the stability of the RSI indicator below the 50 midline.

This encourages us to maintain our negative outlook, noting that confirming a break of 1.2065 Fibonacci retracements of 38.20% as shown on the chart increases and accelerates the strength of the daily bearish trend, so that we are waiting for the next stop at 1.2000 and breaking it pushes the pair to complete the downside correction towards 1.1975, a 50.0% correction.

From the top, crossing to the upside and rising again above 1.2130 will postpone the chances of a reversal, and we may witness a slight bullish tendency aimed at retesting 1.2175 23.60% correction before continuing the decline again.

| S1: 1.2035 | R1: 1.2130 |

| S2: 1.2000 | R2: 1.2195 |

| S3: 1.1940 | R3: 1.2230 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations